Needs, wants and savings

- Needs: these are those bills that you absolutely must pay and are the things necessary for survival (rent or mortgage payments, car payments, groceries, insurance, health care, minimum debt payment, and utilities).

- Wants: these include all the things you spend money on that are not absolutely essential (dinner and movies out, vacations, electronic gadgets, etc.)

- Savings: this includes adding money to an emergency fund in a bank savings account, making IRA contributions to a mutual fund account, and investing in the stock market.

930

2.82K reads

CURATED FROM

IDEAS CURATED BY

Creator. Beer ninja. Travel lover. Twitter evangelist. Lifelong writer. Zombie expert.

The idea is part of this collection:

Learn more about moneyandinvestments with this collection

How to use storytelling to influence and persuade

How to create a compelling narrative

How to structure your story for maximum impact

Related collections

Similar ideas to Needs, wants and savings

50%: Needs

Needs are those bills that you absolutely must pay and are the things necessary for survival. These include rent or mortgage payments, car payments, groceries, insurance, health care,

20%: Savings

Finally, try to allocate 20% of your net income to savings and investments. This includes adding money to an emergency fund in a bank savings account, making IRA contributions to a

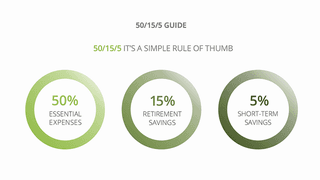

The 50/15/5 rule for multiple financial goals

- 50% of your income goes toward essential expenses: rent, bills, minimum debt payments.

- 15% percent goes to retirement savings. They also suggest you increase this by 1% each year.

- 5% goes toward unexpected monthly expenses or building an emergency...

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates