💰 Maximize Your Money

Saving money is better than not saving at all, but letting it sit in a bank without investing it is not optimal because of inflation and the fact that the bank uses your money to make a profit.

During the Great Depression, people were unable to withdraw their money from banks due to a bank run and the subsequent economic crash.

137

2.22K reads

CURATED FROM

IDEAS CURATED BY

Hi! 🔭 Nice to meet you all. My name is Giovanni, I'm 15 years old and live in Italy. I am a big dreamer and I wish to change the world. My mission is to help as many people as possible embark on the journey of leveling 🆙 in life.

Change your mindset about money, focus on increasing your income, save and invest wisely, and educate yourself.

“

Similar ideas to 💰 Maximize Your Money

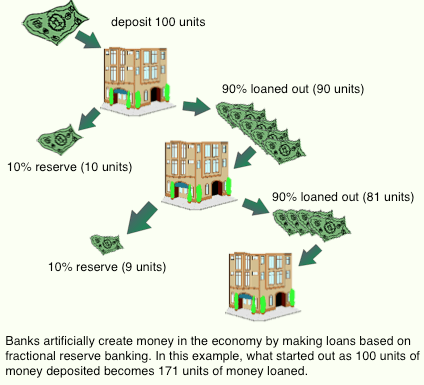

Fractional Reserve & Money Supply

Banks loan money they don't have. Most hold a limited reserve to serve the few who decide to make redraws. When the majority decides to liquidate their bank accounts we have what is called a bank run.

In order to protect the banks, central banks were created to provide a gu...

What happens to your money

Banks don’t like to give away their money. That mindset is reflected in the interest rates of checking and savings accounts of 0,5% and 0.9% avg. annual interest respectively.

When you deposit your money in the bank, the bank turns around and invests that money at 7% a year or more. ...

Wall Street Down

On 29th October 1929, the infamous crash of Wall Street happened, where 30 million dollars were lost in a week, leading to customers rushing to withdraw their money, known as the ‘bank run’.

The entire world felt the capitalistic fall and realized that a boom leads to a bust, even...

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates