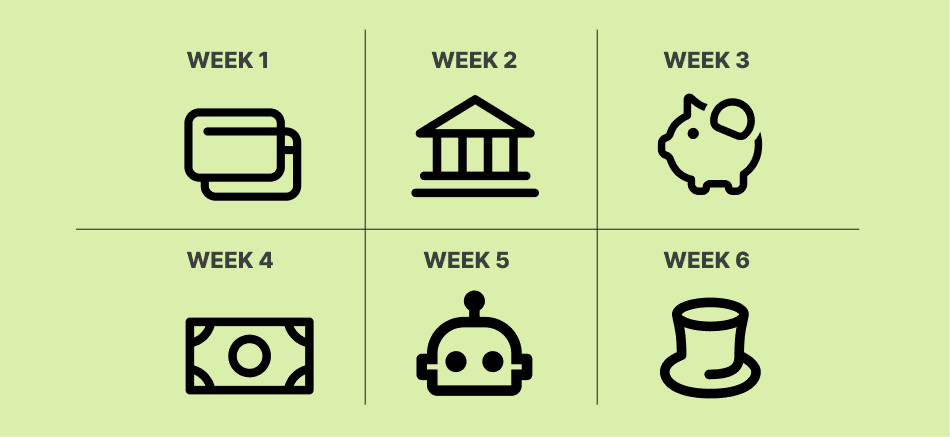

Your Six Week Plan To Become Rich

Do this to get on a path to becoming rich:

- Optimize Your Credit Cards

- Open high-interest, low-maintenance bank accounts

- Open Investing Accounts

- Start Your Conscious Spending Plan

- Automate Everything

- Start Investing

2.4K

16.7K reads

CURATED FROM

IDEAS CURATED BY

The book behind the Netflix show

“

Similar ideas to Your Six Week Plan To Become Rich

Your Job Doesn’t Speak to You

Career-changers are becoming more and more common in this day and age, and you shouldn’t feel stuck on a career path that you don’t connect with.

If you’ve lost your passion for your job, open your mind to other opportunities that do speak to you, and start moving in a direction that you g...

What Are STCS ?

- STCs stand for Share certificates

- Fixed-rate term savings account

- Another way to save

- Issued only by credit unions, whereas CDs are only issued through banks

Pros:

- They are safe (low-risk), offer guaranteed returns, a...

How to deal with your debt

Try to transfer your debt onto a zero-interest credit card (also known as a balance-transfer card). It will give you a limited time window where your debt won't accrue interest and allow you to get rid of your debt faster. But ensure you can pay it off within that window, otherwi...

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates