Explore the World's Best Ideas

Join today and uncover 100+ curated journeys from 50+ topics. Unlock access to our mobile app with extensive features.

Anyone Can Become Rich

This is the main premise of the best selling book by Ramit Sethi. He structures his ideas into 4 buckets:

- Track your spending. This will help you see where your money is going and identify areas where you can cut back.

- Set financial goals. What do you want to achieve with your money? Once you know your goals, you can start making a plan to reach them.

- Pay off your debt. This is one of the most important things you can do to improve your financial situation.

- Invest for your future. This will help you grow your money and reach your financial goals.

2.41K

17.9K reads

“Spend extravagantly on the things you love, and cut costs mercilessly on the things you don’t.”

RAMIT SETHI

2.06K

19.8K reads

4 Life-Changing Ideas About Money

Ramit Sethi lists his favourite approaches to money:

- Behavior trumps information. Knowing the perfect right answer is less important than taking action. Focus on small, innocuous behaviors. Like saving small every month.

- Focus on getting things 85% right. You don’t need to get it perfect. But act.

- Spend on what you love. Cut back on what you don’t. If you love something, spend money (or time) on it. If it’s not important, don’t.

- There are 2 ways to get more money. First, you can earn more. Second, you can spend less. Cutting costs is great, but you can't become rich through savings alone.

2.17K

15.8K reads

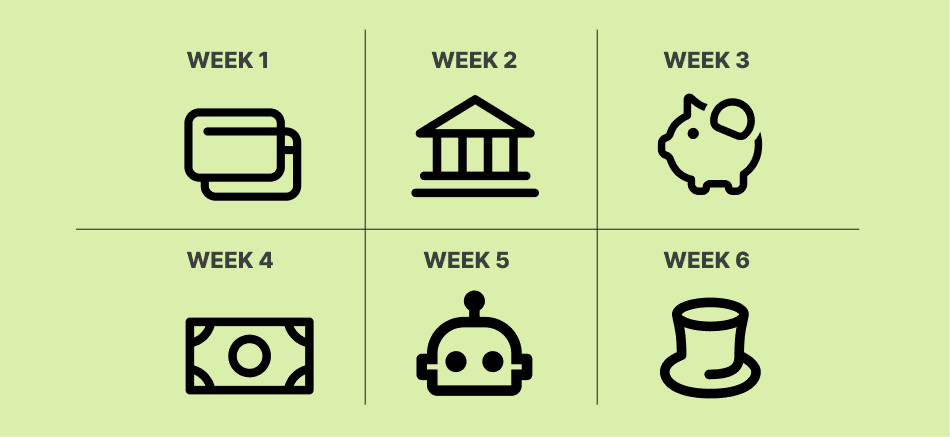

Your Six Week Plan To Become Rich

Do this to get on a path to becoming rich:

- Optimize Your Credit Cards

- Open high-interest, low-maintenance bank accounts

- Open Investing Accounts

- Start Your Conscious Spending Plan

- Automate Everything

- Start Investing

2.4K

16.7K reads

Week 1: Optimize Your Credit Cards

A great place to start because it can have a big impact on your finances:

- Set up autopay to pay your CC bills

- Call to waive any past credit card fees

- Negotiate a lower APR

- Build credit history by keeping credit lines open

- Increased your credit allowance

- Take advantage of rewards

- Build credit. This enables better rates for larger items (for example, a house).

- Improve your credit utilization rate (CUR)

- Use the credit card perks like warranty doubling, car rental insurance, and trip cancellation insurance.

2.11K

11.8K reads

Week 2: Open high-interest, low-maintenance bank accounts

Open a no-fee online bank account (e.g. Ally, Capital One). Avoid brick n’ mortars banks

The problem with brick n’ mortar banks (e.g. Bank of America) is they need minimum balances to avoid fees. For example, Bank of America’s “free” checking account requires a minimum $1,500 balance. This locks up your capital.

1.99K

10K reads

Week 3: Open 2 Investing Accounts

Open:

- a 401(K) account

- a regular investment account.

Next:

- If your employer offers a 401(k) match, invest to take full advantage of it. Contribute enough to get 100 percent of the match.

- Pay off debts. This give you a significant instant return.

- Open a Roth IRA. Contribute as much money as possible. Check the IRS website for current maximum income levels.

- Money left over? Go back to your 401(k). Max this out.

- Money left over? Open a regular non-retirement account. Invest as much as possible.

2.08K

9.02K reads

Week 4: Start Your Conscious Spending Plan

Use a tracking tool to see where your money is going. (e.g. Mint) Don’t just go and “create a budget”.

Choose the things you love enough to spend on— and then cut costs on the things you don’t love. This leads to a happy, rich life, not living a life of frugality for no reason.

Think about your goals. Ask yourself if you’d rather spend $10 on lunch or save $10 toward a house or a car. If you would rather spend the money on lunch, enjoy lunch! You save money so that you can spend it later on the things that make you happy.

2.02K

7.03K reads

Week 5: Automate Everything

Use this schedule to help you set up your own automation:

If you’re paid on the 1st of the month. Switch all bills to arrive on or around that time, too.

- 5th of the month. Set up an automatic transfer to your savings account and to your Roth IRA.

- 7th of the month. Set up automatic payments for your bills, like cable, utilities, car payments, or student loans.

- Set up e-mail notifications. Get notified before your credit card is paid. So you can review it.

- Before you start investing, add a savings goal of 3 months of bare-bones income.

2.01K

6.69K reads

Week 6: Start Investing

Invest in index funds not individual stocks. Put your own behavioral psychology to work here. Invest automatically and over long periods of time.

Once you’ve covered the basics (aka index funds), allocate 5-7% of your income to “mental outlets.” This is money for you to invest or spend however you like.

After you’ve maxed out savings and investments, consider your most important investment: yourself. Take a course, learn new skills, and improve your career trajectory.

2.07K

8.17K reads

IDEAS CURATED BY

CURATOR'S NOTE

The book behind the Netflix show

“

Discover Key Ideas from Books on Similar Topics

10 ideas

The Financial Diet

Chelsea Fagan, Lauren Ver Hage

26 ideas

Your Money or Your Life

Vicki Robin, Joe Dominguez

11 ideas

Our Iceberg Is Melting

John Kotter, Holger Rathgeber

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates