1- Value Investing:

The book introduces the concept of value investing, emphasizing the importance of purchasing stocks at prices significantly below their intrinsic value. Graham's approach focuses on long-term growth and safety rather than short-term market fluctuations.

16

168 reads

CURATED FROM

IDEAS CURATED BY

Being an ambivert person, I am too much fond of reading, and always eager to learn.

In essence, the ideas from "The Intelligent Investor" offer a holistic framework for making well-informed, rational decisions, managing risk, and pursuing long-term growth. These principles extend beyond the realm of investing and are valuable tools for navigating life's challenges and opportunities with prudence and intelligence.

“

Similar ideas to 1- Value Investing:

Value investing

To value investors, an asset isn’t an ephemeral concept you invest in because you think it’s attractive. It’s a tangible object that should have an intrinsic value

capable of being ascertained, and if it can be bought below its

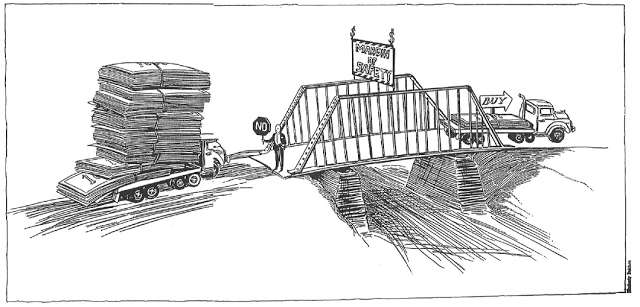

Margin of Safety

This is a principle of investing wherein an investor purchases securities only when their market price is significantly below their intrinsic value.

The formula to determine the intrinsic value of something is:

Margin of Safety = Market Cap / Deep Value Barg...

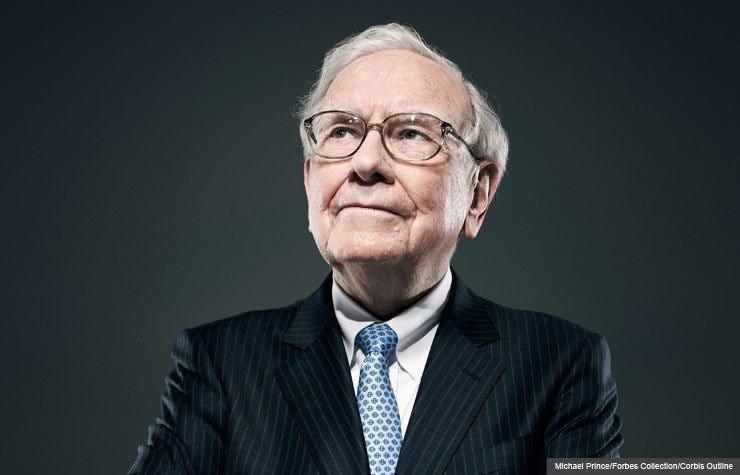

Warren Buffet's Investing Philosophy

- Buffett takes this value investing approach to another level.

- Many value investors do not support the efficient market hypothesis (EMH) . This theory suggests that stocks always trade at their fair val...

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates