1. Budgeting Basics:

Income vs. Expenses: Understand how to balance what you earn and what you spend

Needs vs. Wants: Differentiate between essential expenses and discretionary spending

Savings: Allocate a portion of your income to savings and emergencies.

35

787 reads

CURATED FROM

IDEAS CURATED BY

Financial literacy is a crucial life skill Equip yourself with these six money lessons you need to learn before turning 18:

“

Similar ideas to 1. Budgeting Basics:

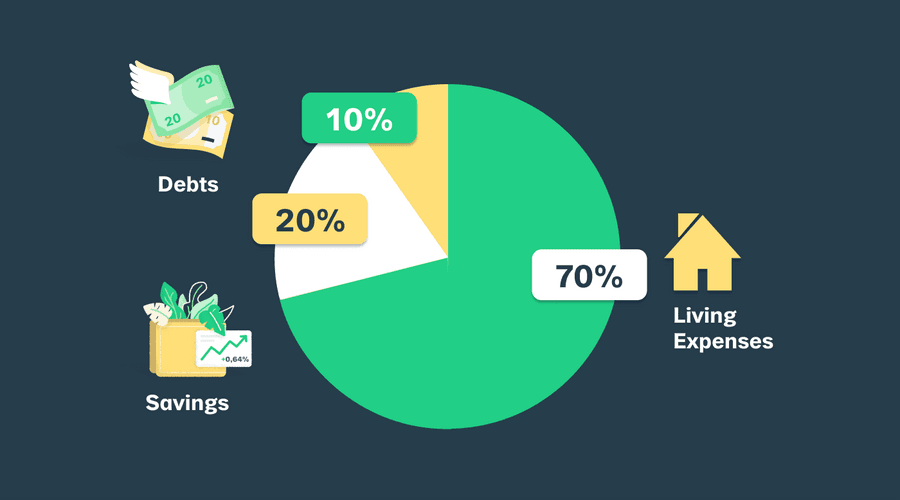

The 70:20:10 budgeting method

This method suggests that you allocate 70 percent of your income to expenses, 20 percent to savings, and the remaining 10 percent to debt.

70:20:10 may work for someone with a healthy emergency fund and minimal debt.

Financial wellbeing

Financial wellbeing can't be measured by only focusing on how much you earn. The gap between what you earn and what you spend is an important figure.

Household savings fell by 30% during a period when median real income rose 40%. Even though Americans earn more than ever before, ...

8. Income - Saving = Expenses

Reality is our equation is always 'Income - Expenses = Savings' But we should priorities our savings and then we can spend freely on our expenses without any regret.

This mindset will eventually help you to have control over your spending and you will spend your money on things which you r...

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates