Practical Steps for Kakeibo

1. Determine Regular Income and Expenses: Identify your regular sources of income and expenses.

2. Plan Monthly Expenses: Create a budget for daily needs, entertainment and savings.

3. Record Daily Expenses: Write down all your expenses to know your spending pattern.

4. Monthly Evaluation: Analyze and evaluate at the end of every month to find out which areas need improvement.

15

125 reads

CURATED FROM

IDEAS CURATED BY

This book discusses practical ways to record expenses and income, as well as reflect on spending habits to achieve financial balance.

“

Similar ideas to Practical Steps for Kakeibo

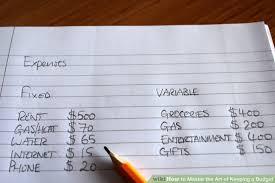

Make a Budget in 6 Simple Steps

- Gather every financial statement you can (bank statements, investment accounts, recent utility bills).

- Record all of your sources of income.

- Create a list of monthly expenses.

- Break expenses into 2 categories: fixed and variable.

Keeping The Budget

Compare the total monthly family income with total monthly expenditures. If you have excess money after paying your bills you can save or invest it, otherwise, you have to reduce expenses, increase revenue, or do both.

Analyze your monthly expenses, and set priorities in spending. After ...

Set s budget

Once you have an idea of what you spend in a month, you can begin to organize your recorded expenses into a workable budget . Your budget should outline how your expenses measure up to your income—so y...

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates