Keeping The Budget

Compare the total monthly family income with total monthly expenditures. If you have excess money after paying your bills you can save or invest it, otherwise, you have to reduce expenses, increase revenue, or do both.

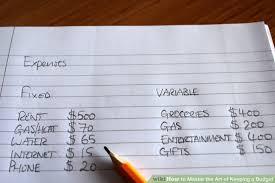

Analyze your monthly expenses, and set priorities in spending. After you separate money for the inescapable expenses, reduce variable costs to easily achieve monthly savings.

70

363 reads

CURATED FROM

IDEAS CURATED BY

The idea is part of this collection:

Learn more about moneyandinvestments with this collection

How to delegate tasks efficiently

How to use technology to your advantage

How to optimize your work environment

Related collections

Similar ideas to Keeping The Budget

Make a Budget in 6 Simple Steps

- Gather every financial statement you can (bank statements, investment accounts, recent utility bills).

- Record all of your sources of income.

- Create a list of monthly expenses.

- Break expenses into 2 categories: fixed and variable.

Budgeting your money is the cornerstone of a sound financial plan, and seeing all the numbers in black and white can offer valuable perspective on where your mone...

WES MOSS

Steps of the zero-sum budget

- Determine how much you make on any given month.

- List your bills: Once you determine how much money you'll make this month, figure out how much money you need to spend next month.

- Compare and contrast: Once you see your monthly income and your monthly bi...

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates