Investment Strategies

- Value investing - Value investors look for stocks that are undervalued in the market, meaning that the market price is lower than the intrinsic value of the stock. Value investors seek to invest in high-quality companies with strong financials and a history of consistent earnings growth.

- Growth investing - Growth investors look for companies that have the potential for above-average earnings growth. These companies typically have innovative products or services and are in growing industries. Growth investors are willing to pay a premium for these stocks in the hope of achieving high returns.

234

669 reads

CURATED FROM

IDEAS CURATED BY

This Book by Benjamin Graham is a classic investment guide that provides timeless wisdom on value investing. It emphasizes the importance of a long-term approach to investing, patience, and discipline. The book teaches readers how to make smart investment decisions based on fundamental analysis and how to protect against the impact of inflation. It also provides practical advice on portfolio management, diversification, and risk management. The book discusses different investment strategies, including the defensive and enterprising investor approaches.

“

Similar ideas to Investment Strategies

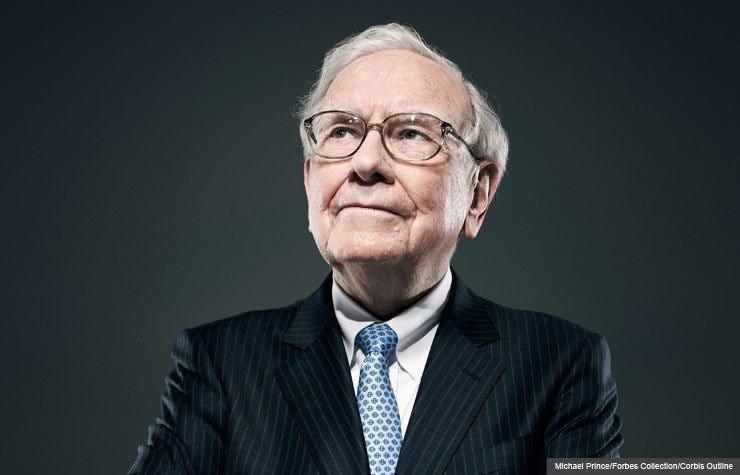

Warren Buffet's Investing Philosophy

- Buffett takes this value investing approach to another level.

- Many value investors do not support the efficient market hypothesis (EMH) . This theory suggests that stocks always trade at their fair val...

What's a good P/E ratio to buy a stock at?

Unfortunately, there's no P/E ratio set in stone that makes a stock a buy if it's below, or a sell if it's above.

Often value investors and growth investors will look for different things in a P/E ratio.

- Value Investors - the lower the P/E ratio the better.

- Growth Inves...

Value Investing

Popularized by investors Benjamin Graham & Warren Buffett, value investing is about buying something for less than it is worth. It's based on this idea that you can find undervalued companies (companies with low P/E - price per earnings). It's hard to do it these days:

- Finding underval...

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates