• Two recent acquisitions of unrelated businesses look like diworseifications, and the company announces it is looking for further acquisitions “at the leading edge of technology.”

• The company has paid so much for its acquisitions that the balance sheet has deteriorated from no debt and millions in cash to no cash and millions in debt. There are no surplus funds to buy back stock, even if the price falls sharply.

• Even at a lower stock price the dividend yield will not be high enough to attract much interest from investors.

116

25 reads

CURATED FROM

IDEAS CURATED BY

These are some lessons that peter lynch thought us in one up on wall street

“

Similar ideas

Dividend Stocks

A dividend stock will usually make a cash payment into your brokerage account every 3 months. Works well as you can take the cash from a dividend payment and use it to buy more dividend stocks.

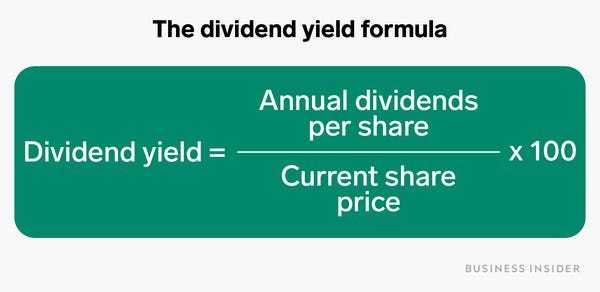

A dividend yield is how much money you make yearly compared to the share price (see image): ...

A fund explained

- A fund is simply another way to buy shares.

- Instead of you buying a slice of a company directly, you give your cash to a specialist manager who pools it with money from other investors (like you) to go and buy a job lot of shares in a stock market.

- Each fund is mad...

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates