Debt payments

Debt payments may look confusing when you add it to the savings column. But the easiest way to build up a savings balance is not to have your money go toward debt. Once your debt is paid off, you can increase the savings.

1.28K

5.49K reads

CURATED FROM

IDEAS CURATED BY

The idea is part of this collection:

Learn more about moneyandinvestments with this collection

How to prioritize tasks effectively

How to manage your time efficiently

How to reduce stress and anxiety

Related collections

Similar ideas to Debt payments

The snowball debt method

With this method, you pay off your debts from the smallest balance to the largest balance, regardless of interest rates.

When you pay the smallest debts first, you start to clear your low debts away very quickly. Doing this feels empowering. Once you've paid off a debt, yo...

How to deal with your debt

Try to transfer your debt onto a zero-interest credit card (also known as a balance-transfer card). It will give you a limited time window where your debt won't accrue interest and allow you to get rid of your debt faster. But ensure you can pay it off within that window, otherwi...

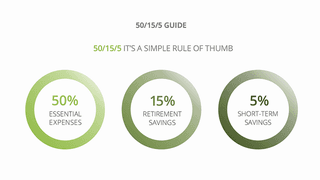

The 50/15/5 rule for multiple financial goals

- 50% of your income goes toward essential expenses: rent, bills, minimum debt payments.

- 15% percent goes to retirement savings. They also suggest you increase this by 1% each year.

- 5% goes toward unexpected monthly expenses or building an emergency...

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates