What does paying yourself mean?

It means setting aside a predetermined amount or percentage of your income for savings and investments. It is the 20% in the 50-30-20 rule. But it is also the most important rule.

Clason insists many times — paying yourself first is the key to a successful life. When you do it, you put your money to work. You allow them to multiply. Also, you secure your future income from any life challenges.

67

371 reads

CURATED FROM

7 Personal Finance Rules You Can't Afford to Ignore

cosmopolitanmindset.substack.com

28 ideas

·8.69K reads

IDEAS CURATED BY

Passionate about self-improvement, personal growth, finance, and creativity. I love to inspire people to become the better version of themselves. Author @ www.cosmopolitanmindset.com

Learn 7 personal finance rules that can make or break your financial future. From budgeting to compound interest, these money habits will help you secure your financial freedom.

“

Similar ideas to What does paying yourself mean?

How much you should save every month

The popular 50/30/20 rule states that you should reserve 50 percent of your budget for essentials like rent and food, 30 percent for discretionary spending, and 20 percent for savings.

But it's not that simple. If you're a high earner, you'd be wise to save a larger percentage of your inco...

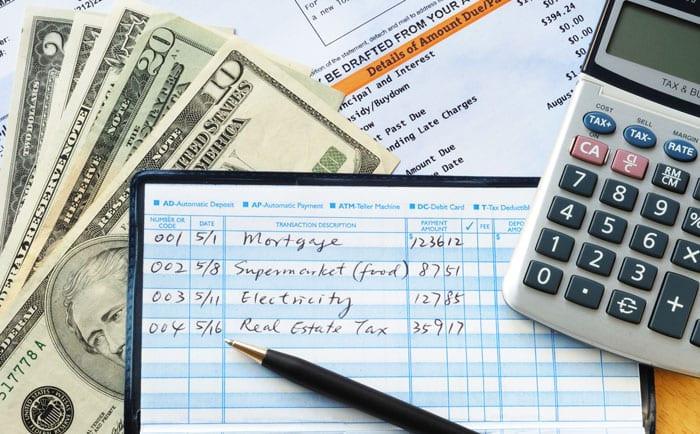

Learn to Budget

Create a plan for your money so you know where it's going every month.

A popular and effective way to budget is with the 50/30/20 rule, where 50% of your income goes towards necessities (bills, food, housing, etc.), 20% of your income goes towards savings a...

The 50/20/30 budgeting method

With the 50/20/30 budgeting method:

- 50% of your monthly spending goes toward essentials - your home, your food, etc.

- 20% of your monthly spending goes toward savings goals. It also includes paying down debts as it helps you build savings la...

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates