Passive and Portfolio Income:

When my rich dad said, “The rich don’t work for money. They have their money work for them,” he was talking about passive income and portfolio income.

Passive income, in most cases, is income derived from real estate investments. Portfolio income is income derived from paper assets such as stocks and bonds.

Portfolio income is the income that makes Bill Gates the richest man in the world, not earned income.

2.52K

5.57K reads

CURATED FROM

IDEAS CURATED BY

The idea is part of this collection:

Learn more about books with this collection

The differences between Web 2.0 and Web 3.0

The future of the internet

Understanding the potential of Web 3.0

Related collections

Similar ideas to Passive and Portfolio Income:

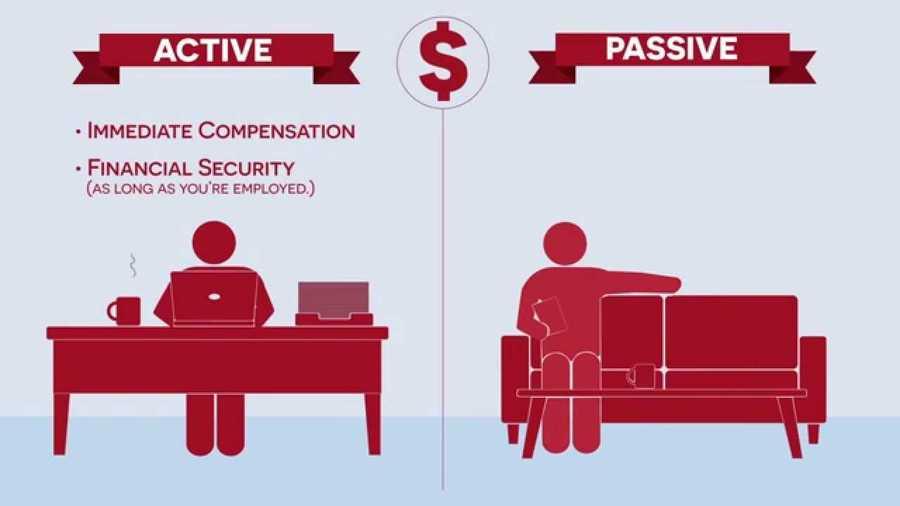

Active vs Passive Income

There are 2 types of income:

Active Income: You are trading time for money. In order to make money you must perform something. Every day you start from zero.

Passive Income: You do not have to be present to generate income. Things like real estate...

Productive assets explained

- Productive assets are investments that internally throw off surplus money from some sort of activity.

- Each type of productive asset has its own pros and cons, unique quirks, legal traditions, tax rules, and other relevant details.

- The three most common...

The quest for passive income

The idea of a diversified portfolio is to have different kinds of active and passive income.

Passive income is investing time and money up front to help earn money continually even while you sleep. It can take many forms, including digital downloads, e-books, selling stock imagery, lic...

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates