Explore the World's Best Ideas

Join today and uncover 100+ curated journeys from 50+ topics. Unlock access to our mobile app with extensive features.

Grow your assets

Understand the difference between an asset and a liability; and grow your income-generating assets' column.

2.66K

29.4K reads

Meaning of wealth

Wealth measures how much money your money is making and, therefore, your financial survivability.

2.57K

19.8K reads

Your best employee is your money.

Once a dollar goes into assets, never let it come out.

Think of it this way: Once a dollar goes into your asset column, it becomes your employee. The best thing about money is that it works 24 hours a day and can work for generations.

2.76K

16.2K reads

Potential within us

We all have tremendous potential, and we all are blessed. Yet the one thing that holds us back is some degree of self-doubt. It is not so much the lack of technical information that holds us back, but more the lack of self-confidence.

2.66K

12.8K reads

5 Roadblocks

There are five main reasons why financially literate people may still not develop abundant asset columns that could produce a large cash flow.

The five reasons are:

- Fear

- Cynicism

- Laziness

- Bad habits

- Arrogance

2.68K

11K reads

Doubts often paralyze us:

We play the “What if?” game. “What if the economy crashes right after I invest?” Or we have friends or loved ones who will remind us of our shortcomings. They often say, “If it’s such a good idea, how come someone else hasn’t done it?”

These words of doubt often get loud.

2.51K

9.07K reads

Welcome new possibilities

Rich Dad believed that the words "I can't afford it" shutdown your brain.

"How can I afford it?" opens up possibilities, excitement and dreams

2.75K

9.59K reads

Analyse > Criticise

In the stock market, I often hear people say, “I don’t want to lose money.” Well, what makes them think I or anyone else likes losing money? They don’t make money because they choose to not lose money.

Instead of analyzing, they close their minds to another powerful investment vehicle, the stock market.

2.44K

8.23K reads

Reason for wanting to be rich?

When people ask me what my reason for wanting to be rich is, I tell them that it is a combination of deep emotional “wants” and “don’t wants.”

2.43K

8.15K reads

Make that choice everyday.

I just choose to be rich, and I make that choice every day.

2.47K

8.18K reads

WARNING:

Don’t listen to poor or frightened people. I have such friends, they are the Chicken Littles of life. To them, when it comes to money, especially investments, it’s always, “The sky is falling! They can always tell you why something won’t work.

But people who blindly accept doom-and-gloom information are also Chicken Littles.

2.46K

7.48K reads

Hardest pill to swallow :

One of the hardest things about wealth-building is to be true to yourself and to be willing to not go along with the crowd.

2.44K

7.91K reads

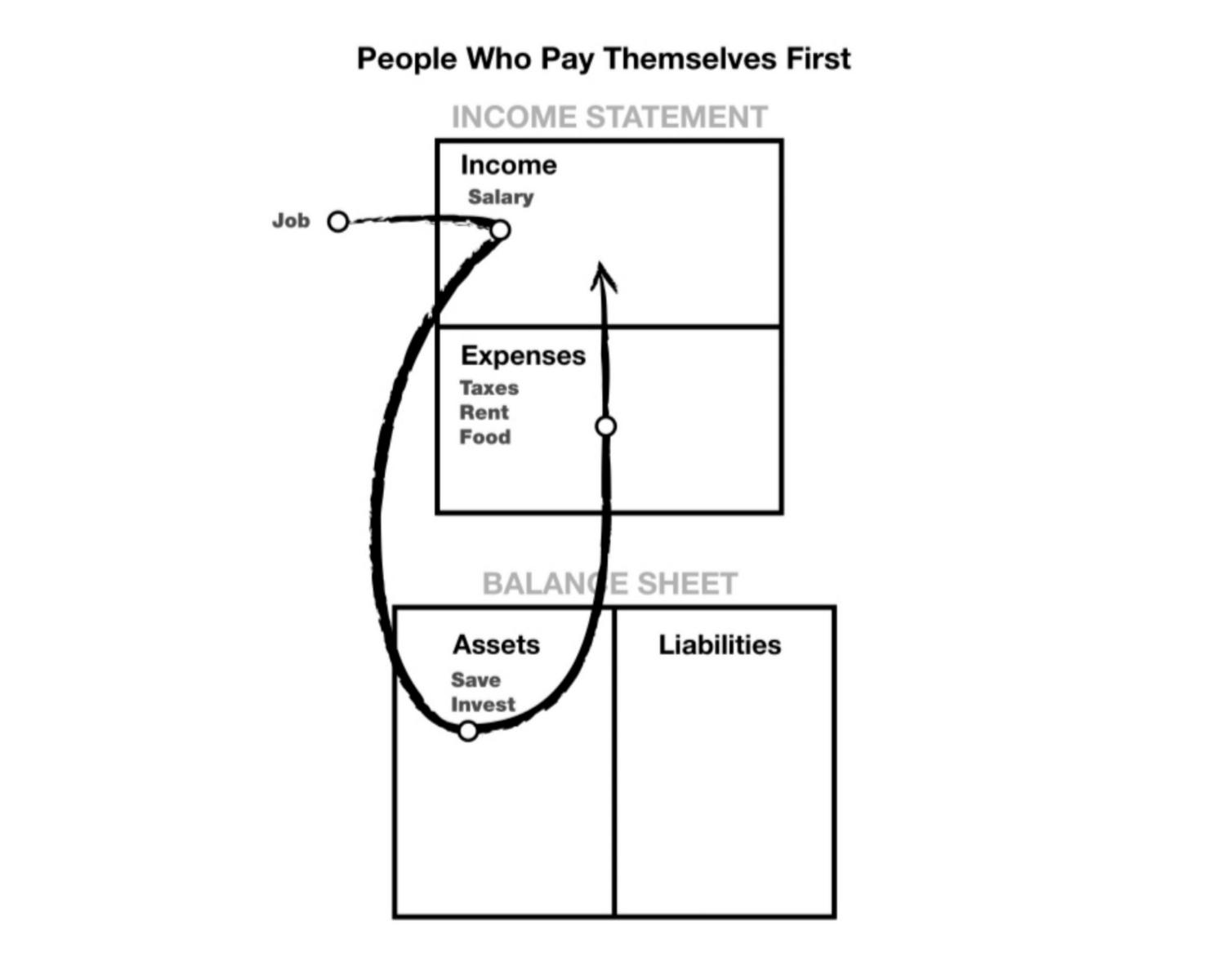

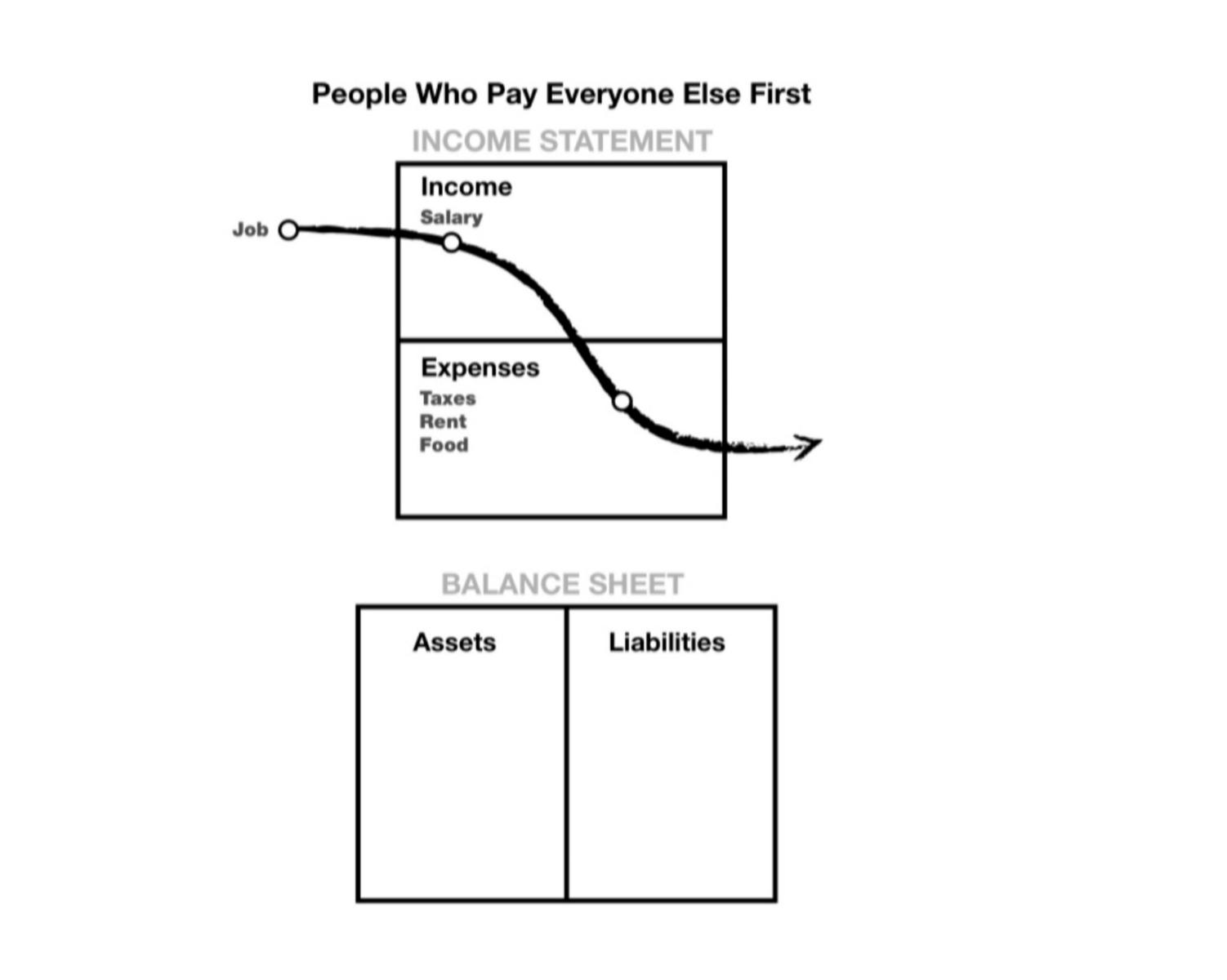

Pay yourself first:

The power of self-discipline If you cannot get control of yourself, do not try to get rich. It makes no sense to invest, make money, and blow it.

2.5K

7.29K reads

How to successfully pay yourself first:

1. Don’t get into large debt positions that you have to pay for. Keep your expenses low. Build up assets first. Then buy the big house or nice car. Being stuck in the Rat Race is not intelligent.

2. When you come up short, let the pressure build and don’t dip into your savings or investments. Use the pressure to inspire your financial genius to come up with new ways of making more money, and then pay your bills. You will have increased your ability to make more money as well as your financial intelligence.

2.66K

6.55K reads

How to overcome financial crisis:

When you get into financial hot water; use your brain to create more income while staunchly defending the assets in your asset column. And be like a good soldier defending the fort—Fort Assets.

2.41K

6.76K reads

The Rich know:

The rich know that savings are only used to create more money, not to pay bills.

2.54K

7.01K reads

Desire to invest

As a habit, I use my desire to consume to inspire and motivate my financial genius to invest.

2.38K

6.49K reads

Choose your Heroes

Choose heroes: the power of myth

By having heroes, we tap into a tremendous source of raw genius.

“If they can do it, so can I.”

2.42K

6.08K reads

Give and you shall receive:

Whenever you feel short or in need of something, give what you want first and it will come back in buckets. That is true for money, a smile, love, or friendship.

Often just the process of thinking of what I want, and how I could give that to someone else, breaks free a torrent of bounty.

2.48K

5.49K reads

Education and wisdom about money are important:

Start early. Buy a book. Go to a seminar. Practice. Start small. I turned $5,000 cash into a one-million-dollar asset producing $5,000 a month cash flow in less than six years. But I started learning as a kid. I encourage you to learn, because it’s not that hard. In fact, it’s pretty easy once you get the hang of it.

2.47K

5.67K reads

The Three Incomes :

The Three Incomes In the world of accounting, there are three different types of income:

- Ordinary earned

- Portfolio

- Passive

2.49K

6.16K reads

Passive and Portfolio Income:

When my rich dad said, “The rich don’t work for money. They have their money work for them,” he was talking about passive income and portfolio income.

Passive income, in most cases, is income derived from real estate investments. Portfolio income is income derived from paper assets such as stocks and bonds.

Portfolio income is the income that makes Bill Gates the richest man in the world, not earned income.

2.52K

5.58K reads

The key to wealth:

Rich dad used to say, “The key to becoming wealthy is the ability to convert earned income into passive income or portfolio income as quickly as possible.”

He would say, “Taxes are highest on earned income. Th e least-taxed income is passive income. That is another reason why you want your money working hard for you. Th e government taxes the income you work hard for more than the income your money works hard for.”

2.54K

5.28K reads

Failures come just a step before success:

Before success comes in any man's life, he is sure to meet with much temporary defeat, and, perhaps, some failure.

When defeat overtakes a man, the easiest and most logical thing to do is to QUIT. That is exactly what the majority of men do.

When failures come along the way, always know that you're close to success🔥

2.48K

5.64K reads

IDEAS CURATED BY

Curious about different takes? Check out our Rich Dad, Poor Dad Summary book page to explore multiple unique summaries written by Deepstash users.

Harsh Deshmukh's ideas are part of this journey:

Learn more about books with this collection

The differences between Web 2.0 and Web 3.0

The future of the internet

Understanding the potential of Web 3.0

Related collections

Different Perspectives Curated by Others from Rich Dad, Poor Dad

Curious about different takes? Check out our book page to explore multiple unique summaries written by Deepstash curators:

1 idea

I-mehak raza's Key Ideas from Rich Dad, Poor Dad

Robert T. Kiyosaki

1 idea

Ankit upadhyay's Key Ideas from Rich Dad, Poor Dad

Robert T. Kiyosaki

1 idea

Bhavin Shankar's Key Ideas from Rich Dad, Poor Dad

Robert T. Kiyosaki

Discover Key Ideas from Books on Similar Topics

3 ideas

Waldorf School Education

Sprouts

6 ideas

3 Things School Taught You Without You Even Realizing It

markmanson.net

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates