Types of inflation

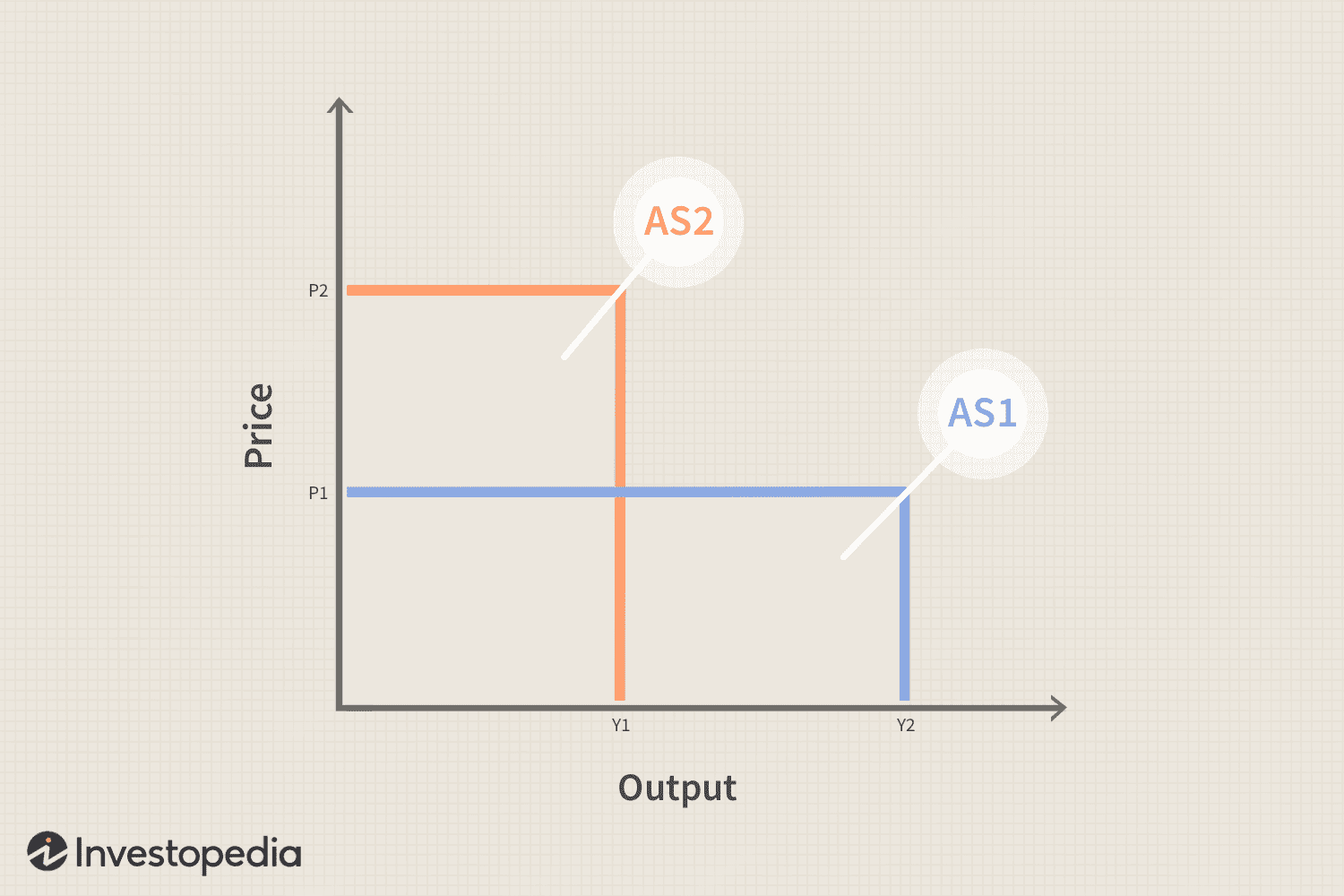

- Cost-push inflation – when a rise in prices is caused by a rise in the cost of production, such as higher oil prices

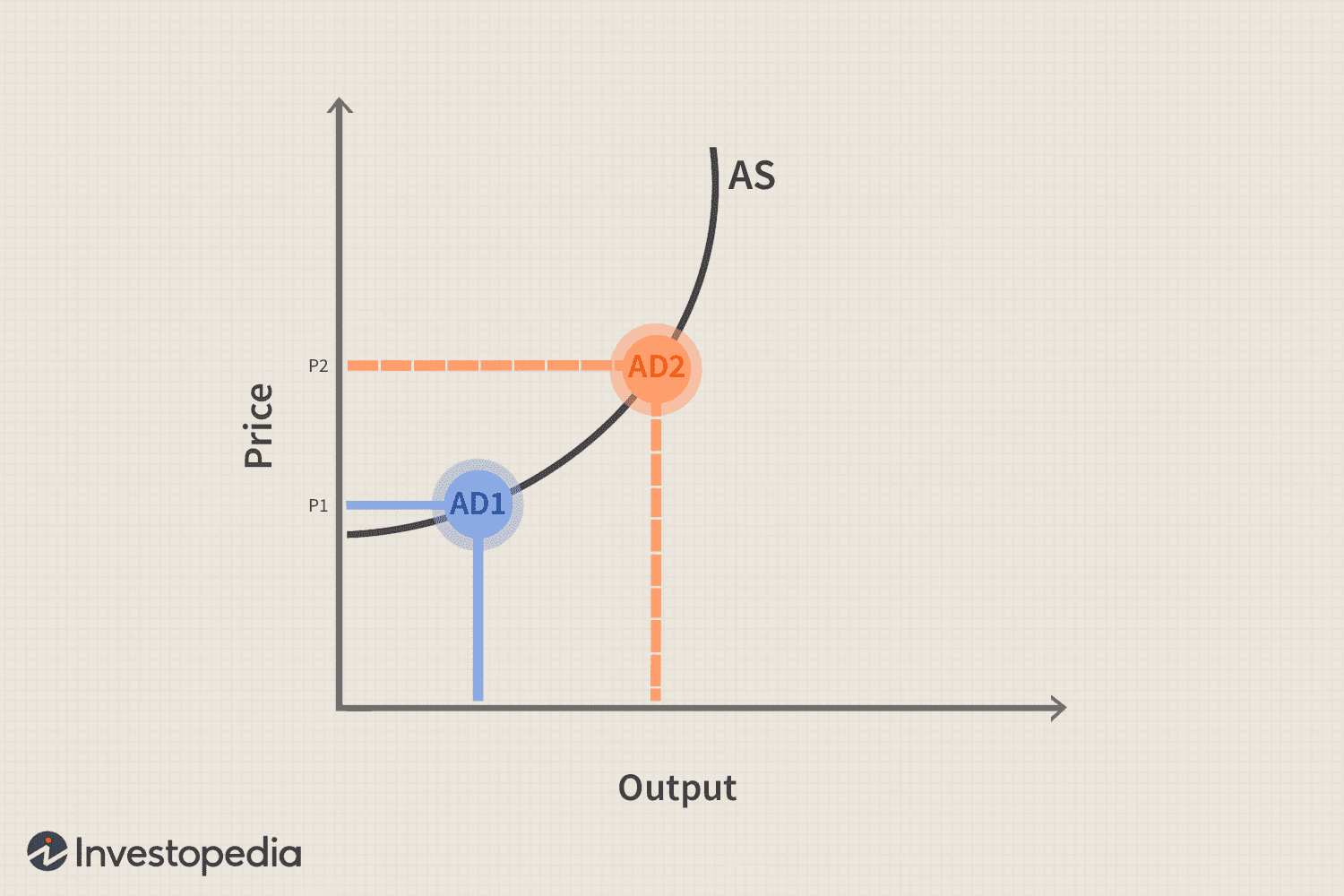

- Demand-pull inflation – when a rise in prices is caused by rising aggregate demand and firms pushing up prices due to the shortage of goods

41

247 reads

CURATED FROM

IDEAS CURATED BY

The idea is part of this collection:

Learn more about moneyandinvestments with this collection

How to challenge assumptions

How to generate new ideas

How to break out of traditional thinking patterns

Related collections

Similar ideas to Types of inflation

Cost-Push Inflation

Cost-push inflation is the decrease in the aggregate supple of goods and services stemming from an increase in the cost of production.

An increase in the costs of raw materials or labor can contribute to cost-pull inflation.

Demand-Pull Inflation

Demand-pull inflation is the increase in aggregate demand, categorized by the four sections of the macroeconomy: households, business. governments. and foreign buyers.

Demand-pull inflation can be cause by an expanding economy, increased government spending, or overseas growth.

Demand shock

Demand shocks occur when the demand for products drops as people stop earning money. A tactic to fix this is to stimulate the economy. In 2008, Australia gave households cash and encouraged them to spend to jumpstart the economy.

In 2020, the problem is also a lac...

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates