12 Personal Finance Tips and Tricks to Make You Rich

Curated from: swiftsalary.com

Ideas, facts & insights covering these topics:

13 ideas

·371K reads

1.72K

17

Explore the World's Best Ideas

Join today and uncover 100+ curated journeys from 50+ topics. Unlock access to our mobile app with extensive features.

Side Hustle to Make More Money

You don't have to sacrifice all of your free time to start a side hustle, use the time you’re comfortable with and make a little bit of progress every day.

5.27K

58K reads

Take Action Today

Get to working on improving your finances today, not tomorrow. Reading the steps and thinking you’re capable of doing it but postponing it is just an excuse, an unprofitable one.

4.65K

40.8K reads

Communicate With Your Partner

Talking about your financial goals, and scheduling time once a month to go over your finances together can prevent money from affecting your relationship.

4.42K

35.4K reads

Start Investing

You should have a savings account, but your money is depreciating if that’s your only investment - average savings don’t yield more than inflation.

Real estate, peer-to-peer lending, exchange traded funds (etfs) and stocks are examples of common investments. Cryptocurrencies occurrences are also an alternative although risky.

5.05K

34.5K reads

Know Your Net Worth

Net worth is what would be left if you were to sell everything you own and pay what you owe. If you have a positive net worth, continue working to increase your net worth, but if you have a negative net worth, analyze your budget and plan how to increase it.

Make sure to re-calculate your net worth every month or so to keep up to date with your finances.

4.64K

26.6K reads

Create an Emergency Fund

You can't predict an emergency, but you can prepare for one. The best way to do so is to set up an emergency fund of 3-6 months of living expenses.

Common financial emergencies include job loss, natural disasters and car, house and health issues.

4.8K

25.2K reads

Good Debt Good, Bad Debt Bad

Is debt acquired to purchase something that is going to benefit you financially in the future, usually with low interest. That means it's either going to generate income or allow you to make more money in the future.

Examples of good debt:

- Student Loans: typically have low interest rate and raises future income, if you are headed to a profitable field you enjoy.

- Mortgages: usually long-term loans with low interest rates and tax deductible interest.

- Business loans: investment towards something with the goal of increasing your net worth.

4.57K

22.5K reads

Credit Card's Danger

Credit card usage can lead to debt and the debt grows itself while unpaid. However, used responsibly, it's a good way to start building credit.

Most credit cards also have other benefits, such as rewards points, cash back, or travel points. But if you're incapable of paying off the balance in full every month, then you shouldn’t have it.

4.21K

20.3K reads

Set Financial Goals

A clear set of goals can keep you motivated and help you plan to reach it faster.

Have different goals for what you want to achieve in the next 3-months, 1 year and 5 years. This way you'll have some short and long-term goals to look forward too.

4.77K

19K reads

Invest on Your Savings First

Act as if your savings account is a bill to pay, so you’re less likely to spend it. Automate savings transfers if possible.

4.58K

24.7K reads

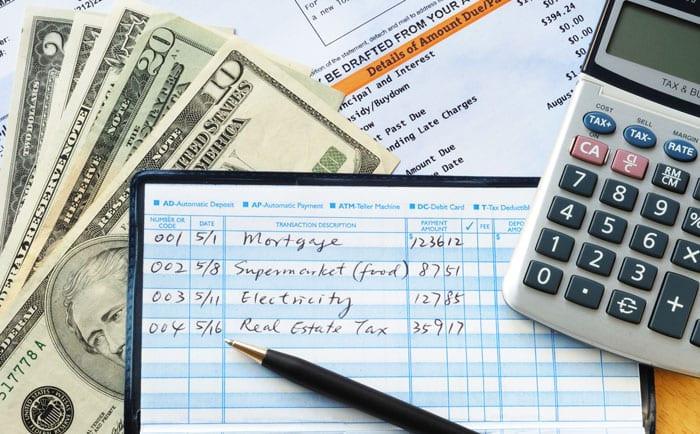

Break Down Your Income & Expenses

Take note of all your expenses, subtract them from your income and find out how much you have left per day, so you have a better idea how long it will take to reach your goals.

This will help you see how far purchases are going to set you back and affect your spending ability.

4.49K

17.5K reads

Learn to Budget

Create a plan for your money so you know where it's going every month.

A popular and effective way to budget is with the 50/30/20 rule, where 50% of your income goes towards necessities (bills, food, housing, etc.), 20% of your income goes towards savings and 30% you can use freely.

5.56K

20.9K reads

Spend Less Than You Earn

In order to do this, you need to track your spending by either writing your purchases down or using a free personal finance app.

4.4K

25K reads

IDEAS CURATED BY

"There's no money in poetry, but then there's no poetry in money, either." ~ Robert Graves

CURATOR'S NOTE

These are pretty basic but we would all be far ahead financially if we did a few of them.

“

Angela 's ideas are part of this journey:

Learn more about moneyandinvestments with this collection

The importance of networking in podcasting

How to grow your podcast audience

How to monetize your podcast

Related collections

Similar ideas

5 ideas

Your Complete Guide to Creating a Monthly Budget in 2020

listenmoneymatters.com

28 ideas

7 Personal Finance Rules You Can't Afford to Ignore

cosmopolitanmindset.substack.com

5 ideas

The Most Common Budgeting Mistakes and How to Fix Them

twocents.lifehacker.com

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates