Explore the World's Best Ideas

Join today and uncover 100+ curated journeys from 50+ topics. Unlock access to our mobile app with extensive features.

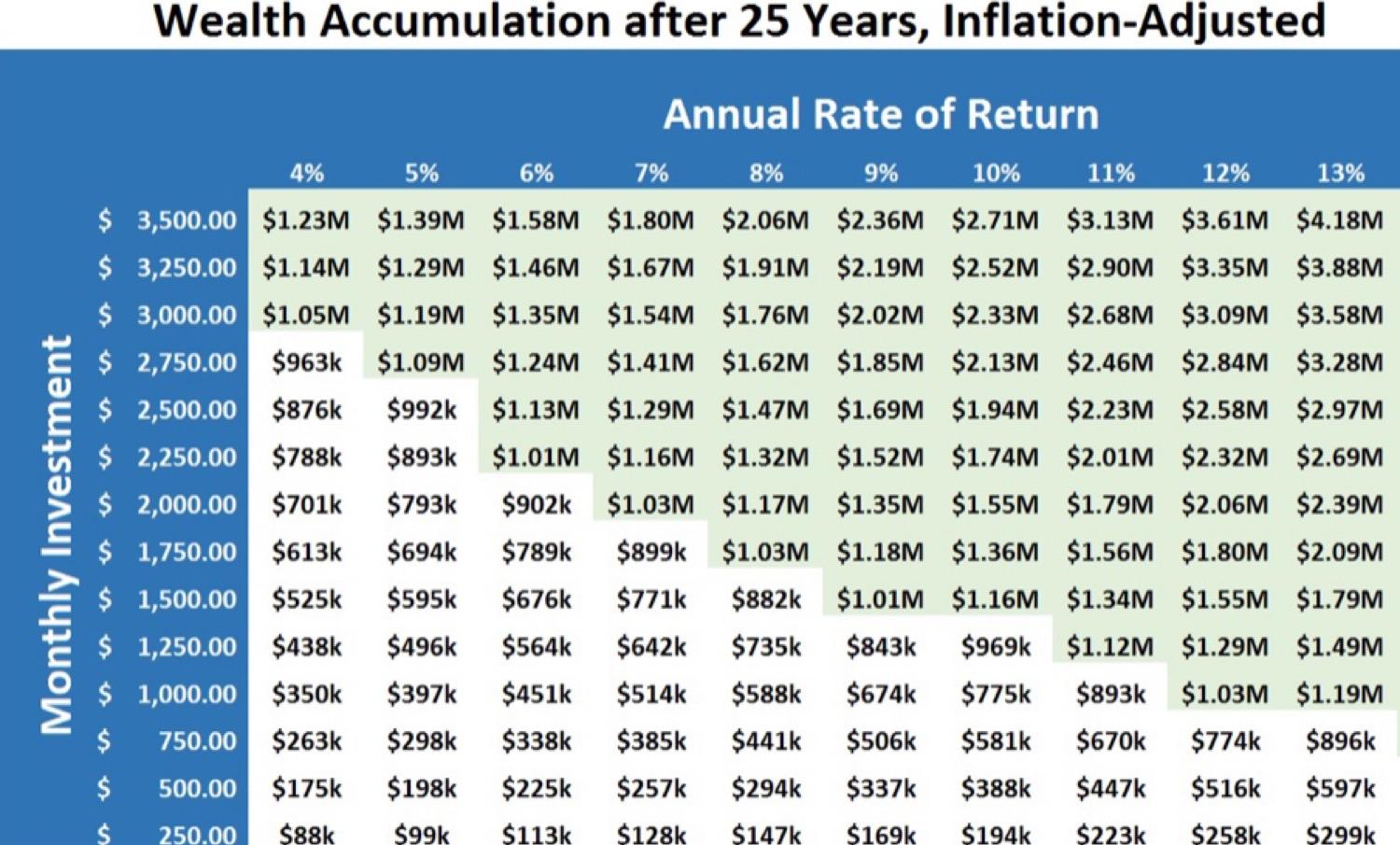

How to Build Wealth: This Chart Tells All

As the chart shows, if you want to build wealth, there are really only two things to get right:

- Increase the difference between your income and expenses

- Save that difference and grow it exponentially over time

That’s it.

This chart shows you exactly how much you need to save, and the rate you need to compound it at, in order to reach your goals!

87

823 reads

How to Increase Your Income and Save More

Worrying about whether your wealth is growing by 6% or 8% per year won’t matter so much if you can’t make enough money to reliably save and invest each month.

Here’s an overview of three ways to earn enough income to start some serious wealth accumulation.

- Pick a high-paying job

- Make money with side hustles

- Start a business, full or part time

80

523 reads

How to Achieve a High Growth Rate on Your Savings Pt.1

To invest money for high rates of return, you usually either need to take on increased risk, increased volatility, or decreased liquidity.

Here’s an overview of how to achieve your target rate of return. Usually you’ll want a blend of several of these asset classes for optimal diversification:

How to produce 0-3% annually:

- Treasuries

- Corporate bonds

- Municipal bonds

- Savings accounts

How to produce 3-8% annually:

- Preferred stock

- Peer-to-peer lending

- Index funds

89

497 reads

How to Achieve a High Growth Rate on Your Savings Pt.2

How to produce 8-12% annually:

- High-yielding dividend stocks

- Emerging markets and other international stocks or ETFs trading at low valuations.

- High-quality Real Estate Investment Trusts and Master Limited Partnerships

- Investment strategies employing the use of cash-secured puts and covered calls to give good returns even in overvalued markets

- Certain alternative investments that offer decent returns in exchange for lower liquidity

How to produce 12-15% annually:

- Top-quartile private equity

- Direct real estate investing

How to produce 15%+ annually:

- Be a world-class investor

- Start a successful business

91

489 reads

IDEAS CURATED BY

Ifeoluwa Adesemowo's ideas are part of this journey:

Learn more about moneyandinvestments with this collection

The importance of innovation

The power of perseverance

How to think big and take risks

Related collections

Similar ideas

2 ideas

5 Key Retirement Planning Steps That Everyone Should Take

investopedia.com

4 ideas

3 Simple Steps to Building Wealth

investopedia.com

5 ideas

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates