Jessica Delgado's Key Ideas from Simple Numbers, Straight Talk, Big Profits!

by Greg Crabtree, Beverly Herzog

Ideas, facts & insights covering these topics:

31 ideas

·46.4K reads

143

4

Explore the World's Best Ideas

Join today and uncover 100+ curated journeys from 50+ topics. Unlock access to our mobile app with extensive features.

Key Takeaways

- Get owner’s compensation right and stop playing games with distributions.

- Breakeven is 10% pretax profits.

- Labour efficiency is the key to profitability. Manage your salary cap and build a team culture around labor productivity.

- Forecasting is better than budgeting. Spend 75% of your time looking ahead at what you plan to make happen and 25% of your time reviewing actual performance.

- Understand the economic value of your business so you have a baseline for equity decisions.

594

5.27K reads

Owner's Salary: Why Your Salary and Distributions are Fogging Your View of Net Income

- Don’t confuse business profits with owner's salary.

- You get paid a salary for what you do, and you get a return on what you own.

- Until you pay yourself a market-based wage and plug that number into your financials, your financial data is worthless.

- If you got run over by a bus today and your heirs decided they would keep the business going in your absence, what would they have to pay someone to do your job? Answering this question determines your market based-wage.

569

3.39K reads

Create A Cash Cow

- If you’re not able to pay yourself a market-based wage, then you’re operating at a loss.

- Until you pay yourself a market-based wage—and make a profit on top of that you have a sick cow on your hands.

- Your goal should be to create a business that generates income for you every day (cash cow).

562

3K reads

Calculate Your Sweat Equity

- Use sweat equity to compensate yourself when you can’t afford a market-based wage.

- Sweat equity is the value you have created for your business through your unpaid work.

- This concept helps you calculate your lost opportunity to earn market-based wages had you chosen to work elsewhere.

- If you have outside investors, it gives you a way to balance the worth of your effort with the money they invested.

536

2.4K reads

Market-Based Wages For All

- A high employee turnover rate is very expensive.

- Fair does not mean equal. Two people are rarely worth the same amount of money.

- Management by committee is an absolute failure as a business model. There has to be a clear leader even if the stock ownership is equal.

540

2.14K reads

Profit: The Importance of Pretax Profit

Pretax Profit = Total Sales – (COGS + Operating Expense + Interest Expense)

- Pretax profit is the profit you make after you take all your sales minus all your costs, before you pay taxes.

- Focus on your pretax profit. Interest, depreciation, and amortization are real numbers that you need to consider in the profit calculation.

- If you can’t pay yourself a market-based wage, the first thing to focus on is getting your business profitable.

539

1.75K reads

Gross Proft And Contribution Margin

Gross Profit = Revenue – COGS

Do NOT include direct labor costs in cost of goods sold.

Cost of goods sold typically includes pass-through costs like finished goods, materials, and subcontractors.

By focusing on gross profit instead of revenue, most businesses from any industry can be compared side to side.

Contribution Margin = Gross Profit – Direct Labor

524

1.53K reads

Breaking Even Isn’t Good Enough

- The target for pretax profit is 10%.

- By the time you’re at the breakeven point, your business is already dead.

- The best businesses operate between 10 percent and 15 percent.

527

1.64K reads

The Black Hole

The “black hole” exists between the $1 million and $5 million in revenue.

This is a time in your business growth when you’re forced to add staffing and infrastructure before you can really afford to.

One of the keys to success is continually upgrading your staff.

The need to add management infrastructure seems to naturally occur when you have about twenty employees typically, when you’re between $2 million and $3.5 million in revenue.

528

1.38K reads

Hiring 101

- Hire slowly, fire quickly.

- Use the topgrading concept of hiring when it comes to interviewing and selecting candidates.

- Use personality profiles as part of the screening process.

- Beware of hiring the “been there, done that” credential. Ask yourself why that person is available.

- Hire young. These young people are like sponges, and they want to absorb knowledge and information.

- Don’t take a trail-and-error approach to hiring. Follow a process and make an informed decision.

544

1.34K reads

Your Capital Safety Net

- Your “capital safety net” is calculated by figuring how much cash you need to hire the people you need, then estimating how long it will be before your business can pay the new hires and still remain profitable.

- Prepare a cash flow forecast by month for the time period of the expansion to determine your capital needs.

- If you don’t have the capital, but still want to go on a journey through the “black hole” then you’ll need to raise capital.

525

1.06K reads

Labour Productivity: Your Key to Surviving the Black Hole

- Focus on your gross profit per labor dollar as your key indicator for labor productivity.

- Stay at the 10% pretax profit mark every step of the way by adding labour only at the last possible moment.

- You can’t increase pretax profit by revenue growth alone. You improve your profitability by getting more productivity out of your labor.

- The profit curve should ideally mirror the revenue curve. As revenue increases, you should maintain 10% profitability.

- Beware of labor creep as you grow. This is when you start hiring more people than you need to take care of the annoying tasks in your business.

521

875 reads

Determining Your Salary Cap

- Determining your salary cap is the best way to achieve your required labour productivity.

- Nonsalary costs include all fixed and variable costs, including COGS, that are not paid labour.

- In the example below, your salary cap for the year is $500,000. This is how much you can spend in total on wages, including all salaried and hourly employees.

512

892 reads

Managing Your Salary Cap

- Managing the salary cap is the key to improving profits.

- If you are exceeding your salary cap, decide what to do about it. Are you going to hold wages constant until you hit your profit target, are you going to cut staff, or are you going to do some of both?

- Once you get to 15% pretax profit, then you can add employees to drive your profit back down to 10% again. Work your way back up to 15% and repeat.

- If you try to raise your salary cap when you have only 10% pretax profit, you’ll drive your profit down toward 5%, which is the danger area.

518

732 reads

Business Physics: The Four Forces of Cash Flow - #1. Paying Your Taxes

- Before you spend money on anything, you have to set the taxes aside.

- Don’t pay taxes until you absolutely have to without incurring a penalty.

- But until you pay the taxes, you have to set the money aside and get it out of your financial calculations so you know it isn’t yours to spend.

516

861 reads

#2. Repaying Debt

- You can’t build wealth until you get out of debt.

- People who take a low- to no-debt approach can handle bad economic news because they live more stable and productive lives.

- If you borrow money, you have to forgo any after-tax profits because you have to repay debt with those profits.

- Do not confuse debt with capital. Capital is the cash you leave in the business to fund your receivables and inventory for normal business conditions, and debt is financing for special cases.

517

749 reads

#3. Reach Your Core Capital Target

- As a general rule of thumb, your core capital target is equal to two months of operating expenses in cash and nothing drawn on a line of credit.

- Your core capital target forces you to pay for accounts receivable, inventory, and equipment with capital or term debt.

516

771 reads

#4. Taking Profit Distributions

- Capital formation is the sum of sweat equity, the money you invest, and after-tax profits that you keep in the business.

- Consistent profits over time allow you to build equity by keeping those profits in the business, which then allows you to hit your core capital target, which then allows you to have excess cash that you can take out without damaging your business’s ability to grow or deal with struggles.

- Most entrepreneurs who have businesses between #1 million and $5 million need to build up a foundation of $2 million of liquid, safe, core assets that give them stability.

517

684 reads

Common Areas of Tax Fraud

- Paying yourself with distributions instead of a salary to avoid payroll taxes (S-Corps).

- Getting involved in offshore activities for the benefit of saving taxes only.

- Intentionally miscoding personal expenses as business expenses.

- Bartering by way of trading legitimate business expenses for something that is for your personal benefit.

- Not filing tax forms for subcontractors.

514

749 reads

Opportunity is missed by most people because it is dressed in overalls and looks like work.

THOMAS EDISON

599

7.22K reads

The Lip Service On Culture

- Document your culture and how it ties into your profitability as a business.

- The more you document it, the easier it is to live it and maintain it.

- Send an email at the beginning of the week that highlights one segment of our culture document to let everyone know what our focus of the week is.

- A company with great culture and no profits is going to die.

- You have to make sure your culture doesn’t excuse people from getting their jobs done.

522

941 reads

The Salary To Give To Employees

- Companies that underpay employees tend to struggle in the long run due to high employee turnover.

- You also can’t assume that if you pay higher wages you’ll get more productivity.

- Never give employees a cost-of-living adjustment.

- What you pay them should be within a market-based range for their role.

- Years of experience often don’t count for much. The important thing is what people know and if they have the capacity to produce.

536

883 reads

Evaluation Process is Key

- Your employees need to understand what is expected of them in terms of productivity.

- The best way to accomplish this is through the employee review process.

- You need to have a formal meeting with each employee at least twice a year.

- Focus on career planning and career path in employee reviews.

- Help employees understand that they are welcome to work at your company as long as you both are getting a fair exchange.

- It’s the responsibility of the CEO to provide employees with a vibrant environment, a fair wage, and a good culture.

532

706 reads

Be Careful With Incentive Plans

- Throwing money at a problem doesn’t change the outcome.

- Most entrepreneurs look to incentive plans as a substitute for management and leadership.

- It’s usually more effective to use small amounts of money along the way to recognize outstanding achievements.

518

770 reads

The Three Sources of Capital: How to Get Money and Effort to Play Nicely

- Capital (Equity) = What you own (Assets) – What you owe (Liabilities)

- Capital is used to purchase assets, such as inventory and equipment, and allows you to have the proper amount of cash on hand to meet your core capital target.

- Debt is NOT capital. The bank does not provide you with capital. They give you debt.

519

731 reads

Source #1: Use Your Own Money

- Look to your own resources first before you go borrow money elsewhere.

- If you start a business with your own money, you’re going to defend it to the greatest degree.

518

783 reads

Source #2: Other People’s Money

- Not all businesses can be funded with debt. Sometimes you need a long-term investor.

- Use investor money as a last resort.

- You tend not to be as careful because it’s not our money. It makes it easier to postpone difficult decisions.

- When you use OPM, you have to be clear about the investors’ expectations and let them know you’re not giving them a salary. They get a salary only if they do a particular job within the business operation.

512

614 reads

Source #3: Sweat Equity

Least understood and least measured form of capital (yet it’s the most common!)

If you can’t afford to pay yourself a market-based wage for your efforts, then you’re going to have to defer payment and work for it.

The trap that most people fall into is believing that because they have a low wage, they can live off the profits of the business. It’s better to live off your savings and let your sweat equity build capital in your business. Then pay yourself a market-based wage when your business reaches 2 or 3 percent pretax profit.

516

599 reads

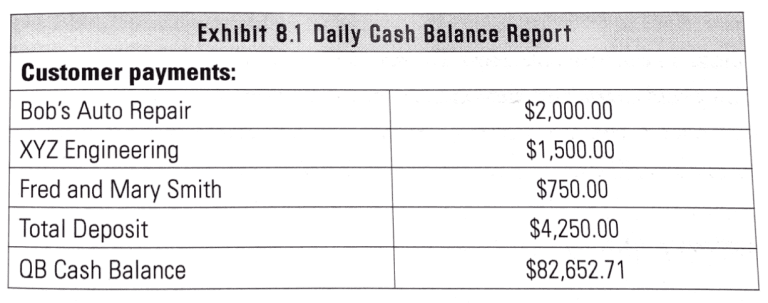

The Golden Rules Of Reports

Keep your reporting simple while still being able to recognize a flashing red light that indicates a problem.

The more frequently you look at a report, the less data it should contain.

519

718 reads

Economic Value: How to Know What Your Business is Worth to You

- Knowing the economic value of your business helps you identify when the business is underperforming, what price it should sell for, whether or not you should keep it, and how to structure an offer for shares.

- The economic value of a business is typically based on the last three years of pretax profit plus the equity in a business.

- This approach takes into account not only the economic activity of the business, but also how well it is capitalized.

- The valuation will be lower if the business has a lot of debt.

516

551 reads

The Five Basic Elements of Value

There are five basic elements that combine to drive the profits that are used to establish the value of your business: customers, employees, processes and know-how, core capital, and intellectual property.

Profitability, salary cap management, and the four forces of cash flow are all contained these five elements of value.

#1. CUSTOMERS

#2. EMPLOYEES

#3. PROCESS AND KNOW-HOW

#4. CORE CAPITAL

#5. INTELLECTUAL PROPERTY

526

670 reads

IDEAS CURATED BY

CURATOR'S NOTE

This book teaches the fundamentals of owner compensation, profit targets, labour productivity, cash flow, and data reporting. Clear explanations and helpful illustrations throughout make it a must-read guide for small business owners looking to achieve higher profits.

“

Jessica Delgado's ideas are part of this journey:

Learn more about business with this collection

The importance of innovation

The power of perseverance

How to think big and take risks

Related collections

Discover Key Ideas from Books on Similar Topics

20 ideas

Financial Intelligence for Entrepreneurs

Karen Berman, Joe Knight, John Case

6 ideas

Profit First

Mike Michalowicz

24 ideas

The Startup Owner's Manual: The Step-By-Step Guide for Building a Great Company

Steve Blank, Bob Dorf

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates