What Does Psychology Have to do With Financial Planning? | Facet Wealth

Curated from: facetwealth.com

29

Explore the World's Best Ideas

Join today and uncover 100+ curated journeys from 50+ topics. Unlock access to our mobile app with extensive features.

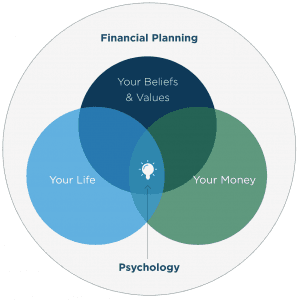

Psychology of Money: Your Beliefs About Money Can Impact how you Manage it

Have you ever spent money on something you knew was stupid, silly, or ill-advised? Have you ever known what you “should” do with your money, and then not done it? Do you procrastinate about important financial decisions, afraid you’ll make the wrong move? And then beat yourself up about it?

Here are two pieces of good news. You’re normal. And these are issues that can be solved.

We all have beliefs about money. Many of those beliefs were formed when we were young, maybe before we even knew what money really was. Sometimes those beliefs get in the way of our financial peace of mind.

64

1.53K reads

Where Our Beliefs Come From

- Many of the attitudes we’ve internalized come from our childhood. Even when we don’t realize it, things our parents said and things we saw them do shaped our attitudes about life in general and our financial lives in particular.

- Culture and religion play a role, too, teaching us additional lessons about earning, spending, saving, and giving. Everything from “the stock market is a gamble” to “donate a percentage of your income to those less fortunate” are lessons we absorbed.

If those beliefs help us make the financial decisions that are best for us, great. But all too often they may get in the wa

61

1.37K reads

Working With A Financial Planner

Chances are, your path to financial health involves several major questions. Should you invest more or pay down your mortgage? Should you save more for retirement or for your child’s dream college?

The right answers aren’t about how well a given investment performs. The answers that are best for you, and only you, need to include your attitudes toward debt, your feelings about risk, and the value you place on your financial goals. How important is it to you to be debt-free? To own a home? To pay for your child’s education?

65

1.3K reads

IDEAS CURATED BY

Sheila James's ideas are part of this journey:

Learn more about moneyandinvestments with this collection

How to develop a healthy relationship with money

How to create a budget

The impact of emotions on financial decisions

Related collections

Similar ideas

5 ideas

4 ideas

The best 7 pieces of advice about you about money in your 30s

businessinsider.com

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates