5 Steps to Become a “Millionaire Next Door” - Darius Foroux

Curated from: dariusforoux.com

Ideas, facts & insights covering these topics:

8 ideas

·7.77K reads

80

1

Explore the World's Best Ideas

Join today and uncover 100+ curated journeys from 50+ topics. Unlock access to our mobile app with extensive features.

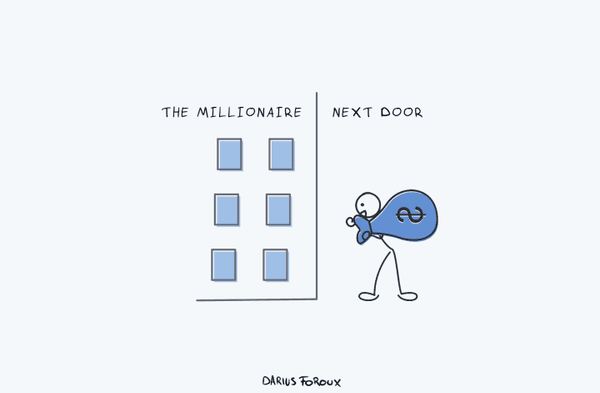

The Millionaires Next Door

A US researcher discovered that many people who lived in expensive homes didn’t have much wealth. Instead, each millionaire he found didn’t look like a millionaire.

- They lived in middle-class neighborhoods, instead of “upscale addresses”

- They didn’t own the latest model cars or expensive watches

- They didn’t wear luxury clothing brands

- and so forth.

63

1.17K reads

“We discovered who the wealthy really are and who they are not. And, most important, we have determined how ordinary people can become wealthy.”

THOMAS STANLE

56

1.13K reads

Pick The Right Profession

Here are the 5 steps you can take to build wealth and eventually become a “millionaire next door.”

Stanley identifies several professions in his book that would potentially earn well in the long term. But the most important aspect of a “right” career is a job that won’t become extinct in the future.

59

988 reads

Several Income Streams

The pandemic has shown us that having a single income stream is too unstable. Just ask those restaurant owners who closed for months during the lockdowns. Or those employees who were let go.

Multiple income streams give us options. And options provide us with freedom and peace of mind. That doesn’t mean you need to own many businesses or work 5 side hustles.

“Wealth is a plentiful supply of a particular desirable thing.”

63

918 reads

Don't Let Outcome Dictate

Having specific goals is fine. But try not to get too attached to outcomes.

For example, whether or not your business or job will earn you six figures in a few years is not entirely within your control. You can only control what you do and how you react to things.

61

920 reads

Save Before Investing

Most people don't invest. After all, over 45% of adults around the globe aren’t capable of paying out of pocket for an emergency.

That means most people are not benefiting from the power of compounding. And they’re not leveraging the long-term growth of the market.

For people living paycheck-to-paycheck, the first priority is to build an emergency fund . Even just enough to cover a whole month’s expense. It’s best to start small, then aim for 6-months’ worth of expenses.

61

884 reads

Your Partner

“It’s important to associate with people that are better than yourself and actually the most important decision many of you will make, not all of you, will be the spouse you choose. And you really want to associate with people who are the kind of person you’d like to be.You’ll move in that direction. And the most important person by far in that respect is your spouse. I can’t overemphasize how important that is.”

It’s no surprise The Millionaire Next Door data reports that most frugal millionaires have married spouses who are also frugal themselves. This avoids two things.

57

882 reads

Partner Part 2

First, one doesn’t get stuck with a spouse who wastes all the money. Because it doesn’t matter how frugal or wealthy a person is if their spouse spends it all.

And people can prevent one of the top reasons why married couples fight: money.4 When you partner with someone who has the same money mindset, you’re less likely to have financial disagreements.

61

875 reads

IDEAS CURATED BY

CURATOR'S NOTE

All those who want to become more wealthy should read this

“

LuX Clara's ideas are part of this journey:

Learn more about psychology with this collection

How to create customer-centric strategies

The importance of empathy in customer success

The impact of customer success on business growth

Related collections

Similar ideas

1 idea

Become a Millionaire…With 500 Bucks a Month - Darius Foroux

dariusforoux.com

5 ideas

The pseudo-affluent: If you look rich, you probably aren't

thinksaveretire.com

7 ideas

Rich vs. Wealthy: What's the Difference?

personalfinanceforbeginners.com

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates