Learning Forex (Preschool) - Who Trades Forex?

Curated from: babypips.com

Ideas, facts & insights covering these topics:

15 ideas

·1.21K reads

9

Explore the World's Best Ideas

Join today and uncover 100+ curated journeys from 50+ topics. Unlock access to our mobile app with extensive features.

Stock Market

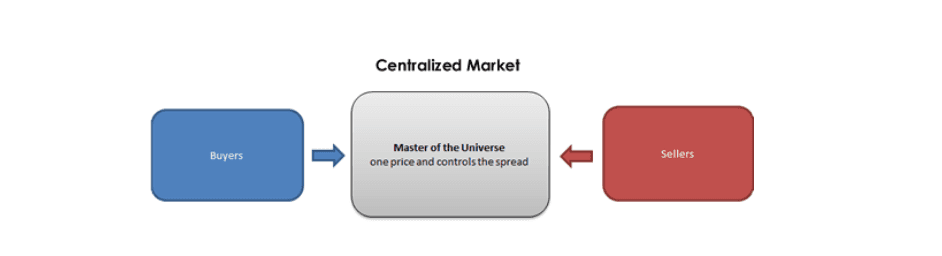

By its very nature, the stock market tends to be very monopolistic. There is only one entity, one specialist that controls prices.

All trades must go through this specialist. Because of this, prices can easily be altered to benefit the specialist and not traders.

In the stock market, the specialist is forced to fulfill the order of its clients. The specialist is able to widen the spread or increase the transaction cost to prevent sellers from entering the market.

16

171 reads

Trading Spot Forex is Decentralized

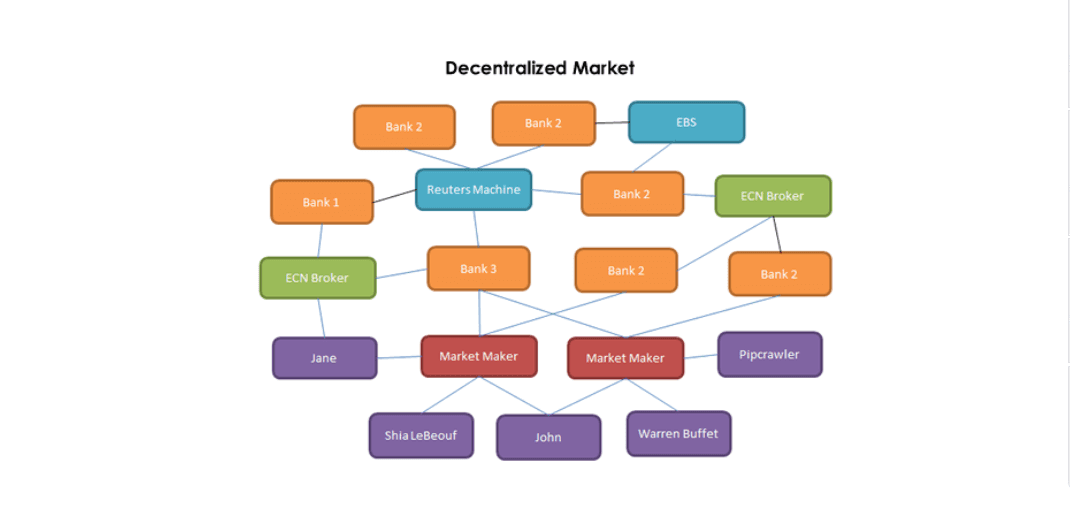

In the forex market, there is no single price for a given currency at any time, which means quotes from different currency dealers vary.

The market is so huge and the competition between dealers is so fierce that you get the best deal almost every single time.

17

156 reads

The Forex Ladder

The participants in the FX market can be organized into a ladder.

At the very top of the forex market ladder is the interbank market.

Composed of the largest banks in the world, the participants of this market trade directly with each other (“bilaterally”) or through voice or electronic brokers (such as EBS Market and Reuters/Refinitiv Matching).

- EBS platform: EUR/USD, USD/JPY, EUR/JPY, EUR/CHF, and USD/CHF are more liquid.

- Reuters platform: GBP/USD, EUR/GBP, USD/CAD, AUD/USD, and NZD/USD are more liquid.

Next on the ladder are the hedge funds, corporations, retail market makers, and retail ECNs.

17

121 reads

Forex Market Players

It is essential for you to understand the nature of the spot forex market and who are the main forex market players.

Forex was originally intended to be used by bankers and large institutions, and not by us “little folks.”

However, because of the rise of the internet, online forex brokers are now able to offer trading accounts to “retail” traders like us.

The major forex market players:

- The Super Banks

- Electronic Liquidity Providers (ELPs)

- Large Commercial Companies

- Governments and Central Banks

- The Speculators

18

94 reads

The Super Banks

When it comes to forex trading, commercial banks and financial institutions are the movers and shakers.

Since the forex spot market is decentralized, it is the largest banks in the world that determine the exchange rates.

They’re responsible for most of the daily trading volume, and they make their money by acting as market makers.

This means they’re constantly buying and selling currencies, pocketing the difference between the bid and ask prices.

A couple of these include Citi, JPMorgan, UBS, Barclays, Deutsche Bank, Goldman Sachs, HSBC, and Bank of America.

17

84 reads

Electronic Liquidity Providers (ELPs)

ELPs are specialized firms using advanced technology and trading algorithms to provide liquidity to market participants.

Examples of ELPs are Citadel Securities, Flow Traders, HC Tech, Jump Trading, Virtu Financial, and XTX Markets.

They operate as intermediaries between buyers and sellers in the currency market, constantly quoting bid and ask prices for various currency pairs.

They also ensure that market participants can find counterparties for their trades, allowing for faster execution and reducing the potential impact of market volatility.

17

71 reads

Large Commercial Companies

The purpose for companies in Forex is to do business such as paying for goods & services, hedging their exposure to currency fluctuations, & managing the cash flow.

Since the volume they trade is much smaller than those in the interbank market, this type of market player typically deals with commercial banks for their transactions.

Mergers and acquisitions (M&A) between large companies can also create currency exchange rate fluctuations.

In international cross-border M&As, a lot of currency conversions happen that could move prices around which still have a significant impact on the market.

17

58 reads

Governments and Central Banks

Governments and central banks, such as the European Central Bank, the Bank of England, and the Federal Reserve, are regularly involved in the forex market too.

National governments

- They participate in the forex market for their operations, international trade payments & handling their foreign exchange reserves.

Central banks

- Responsible for implementing monetary policies that can move currency values.

- Adjust interest rates and control the money supply.

- There are also instances when central banks intervene, either directly or verbally, in the forex market when they want to realign exchange rates.

17

59 reads

The Speculators

Speculation in the forex market involves the buying and selling of currencies with the view of making a profit.

Speculators are focused on price fluctuations.

It is called speculation because of the uncertainty involved since no one can know for sure whether a currency pair’s price will go up or down.

Traders assess the likelihood of either scenario before placing a trade.

Two types of speculators:

- Hedge funds

- Retail traders

17

54 reads

Hedge Funds and Prop Firms: The Smart Money

Hedge funds and prop firms are known as the “smart money” in the forex market.

These savvy traders use advanced strategies and advanced analytical tools to make educated bets on currency movements.

They’re not afraid to take risks, and they often employ leverage to make their bets even bigger.

17

63 reads

Retail Traders: The Little Folks with Big Dreams

These are individual traders who trade currencies from their home computers, smartphones, or tablets.

They may not have the deep pockets or sophisticated tools of the big players, but they’re a growing force in the forex market.

They may not move the market like the big players, but they’re an essential part of the forex ecosystem.

18

55 reads

The Early Days: When FX Trading Was a Members-Only Club

Retail FX trading emerged in 1970s after the Bretton Woods system, which had pegged global currencies to the US dollar, was dismantled in 1971.

The resulting shift to a floating exchange rate system paved the way for increased currency speculation and the birth of the modern foreign exchange market.

Back then, FX trading was like an exclusive club, with trading accessible only to banks, hedge funds, and large corporations.

17

57 reads

The 1990s: Enter the Internet and a New Era of Retail FX Trading

Once the 1990s came along, thanks to computer nerds and the booming growth of the internet, banks began creating their own trading platforms.

These platforms were designed to stream live quotes to their clients so that they could instantly execute trades themselves.

Meanwhile, some smart business-minded marketing machines introduced internet-based trading platforms for individual traders or “retail forex brokers“, these entities made it easy for individuals to trade by allowing smaller trade sizes.

17

54 reads

The Explosion of Online Forex Brokers and Trading Platforms

The early 2000s saw an explosion of online brokers, each eager to offer retail FX trading services.

The increased competition among brokers led to tighter spreads, lower trading costs, and an expansion of trading products beyond major currency pairs.

Today, retail FX traders have access to a wide range of trading platforms even some are available in mobile phones.

17

52 reads

Regulatory Evolution and the Protection of Retail Traders

The growth of retail FX trading attracted the attention of financial regulators, who sought to protect individual traders from shady forex brokers and maintain market integrity.

They introduced strict rules & requirements for FX brokers, making sure they had enough capital, managed risk properly, and treated customers fairly.

Prominent regulatory agencies in the retail FX industry include the US Commodity Futures Trading Commission (CFTC), the UK Financial Conduct Authority (FCA), the Australian Securities and Investments Commission (ASIC) & the European Securities and Markets Authority (ESMA).

17

63 reads

IDEAS CURATED BY

CURATOR'S NOTE

I want to make summary of what I have learned about Forex so that I can refresh it again.

“

Similar ideas

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates