Learning Forex (Preschool) - Margin Trading 101: Understand How Your Margin Account Works

Curated from: babypips.com

Ideas, facts & insights covering these topics:

17 ideas

·1.42K reads

9

Explore the World's Best Ideas

Join today and uncover 100+ curated journeys from 50+ topics. Unlock access to our mobile app with extensive features.

What is Margin Trading?

The biggest appeal that forex trading offers is the ability to trade on margin.

Margin trading gives you the ability to enter into positions larger than your account balance.

With a little bit of cash, you can open a much bigger trade in the forex market.

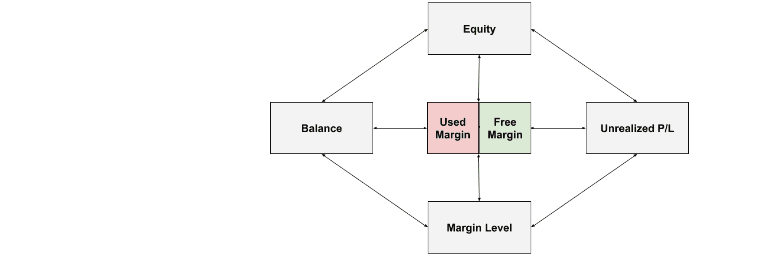

A margin trading account displays the following metrics:

- Balance

- Used Margin

- Free Margin

- Unrealized P/L

- Equity

- Margin Level

As a trader, you need to be aware of the relationships between them.

18

235 reads

What is Account Balance?

In order to start trading forex, you need to open an account with a retail forex broker or CFD provider.

Once your account is approved, then you can transfer funds into the account.

This new account should only be funded with “risk capital”, which is cash you can afford to lose.

Your Balance measures the amount of cash you have in your trading account.

Your Balance will only change in one of three ways:

- When you add more funds to your account.

- When you close a position.

- When you keep a position open overnight and either receive or pay swap/rollover fee.

17

144 reads

What is Unrealized P/L and Realized P/L?

When trading, there are actually two different types of “profit or loss”, also known as “P/L”.

- Unrealized P/L or Floating P/L refers to the profit or loss held in your current open positions or your currently active trades. Your unrealized P/L continuously fluctuates (or “floats”) with the current market prices if you have open positions & you have NOT closed the trade yet.

- Realized P/L refers to profit/loss from a completed trade. Your profits/losses only become realized when the positions are CLOSED. This is the only time when your account balance will change to reflect any gains or losses.

16

131 reads

Profit Isn’t Real Until It’s Realized

- Realized profits are gains that have been converted into cash and ADDED to your account balance.

- Realized losses are losses that have been converted into cash and DEDUCTED from your account balance.

In other words, for you to realize profits from a trade you’ve made, you must receive cash and not simply observe the value of your trade increase without exiting the trade.

Realized P/L can no longer be affected by price changes because it is no longer part of an active trade.

17

95 reads

What is Margin?

When trading forex, you are only required to put up a small amount of capital to open and maintain a new position.

This capital is known as the margin.

Margin can be thought of as a good faith deposit or collateral that’s needed to open a position and keep it open.

Margin is NOT a fee or a transaction cost.

Margin is simply a portion of your funds that your forex broker sets aside from your account balance to keep your trade open and to ensure that you can cover the potential loss of the trade.

This portion is “used” or “locked up” for the duration of the specific trade.

16

98 reads

What is Required Margin?

Required Margin is the amount of money that is set aside & “locked up” when opening a position. It is also known as Deposit Margin, Entry Margin, or Initial Margin.

When trading with margin, the amount of margin (Required Margin) needed to hold open a position is calculated as a percentage (Margin Requirement) of the position size (Notional Value).

The specific amount of Required Margin is calculated according to the base currency of the currency pair traded.

If the base currency is DIFFERENT from your trading account’s currency, the Required Margin is then converted to your account denomination.

16

88 reads

What is Used Margin?

Used Margin is the TOTAL amount of margin currently in use to maintain all open positions.

Said differently, it is the SUM of all Required Margin being used.

If you open more than one position at a time, each specific position will have its own Required Margin.

If you add up all of the Required Margin of all the positions that are open, the total amount is what’s called the Used Margin.

While Required Margin is tied to a SPECIFIC trade, Used Margin refers to the amount of money you needed to deposit to keep ALL your trades open.

14

70 reads

What is Equity?

Equity is your account balance plus the floating profit (or loss) of all your open positions.

Equity represents the “real-time” value of your account.

As your current trades rise or fall in value, so does your Equity.

- If you do NOT have any open positions, then your Equity is the same as your Balance.

- If you have open positions, your Equity is the sum of your account balance and your account’s floating P/L.

- Your account equity continuously fluctuates with the current market prices as long as you have any open positions.

15

63 reads

The Difference between Equity & Balance

If your account is “flat” or does NOT have any positions open, then your Balance and Equity are the SAME.

But if you do have open positions, this is when the Balance and Equity differ.

- The Balance reflects your profit/loss from closed positions (realized P/L).

- The Equity reflects the real-time calculation of your profit/loss. The Equity takes into account both open & closed positions (Unrealized P/L).

This means that when you’re looking at your Balance, it is NOT the actual real-time amount of your funds.

15

57 reads

What is Free Margin?

Free Margin is the money that is NOT “locked up” due to an open position and can be used to open new positions.

When Free Margin is at zero or less, additional positions cannot be opened.

Free Margin can be thought of as two things:

- The amount available to open NEW positions.

- The amount that EXISTING positions can move against you before you receive a Margin Call or Stop Out.

Free Margin is also known as Usable Margin, Usable Maintenance Margin, Available Margin, and “Available to Trade“.

Here’s how to calculate Free Margin:

- Free Margin = Equity - Used Margin

15

59 reads

What is Margin Level?

The Margin Level is the percentage (%) value based on the amount of Equity versus Used Margin.

- The higher the Margin Level, the more Free Margin you have available to trade.

- The lower the Margin Level, the less Free Margin available to trade, which could result in something very bad like a Margin Call or a Stop Out

Here’s how to calculate Margin Level:

- Margin Level = (Equity / Used Margin) x 100%

If you don’t have any trades open, your Margin Level will be ZERO.

Margin Level is very important. Forex brokers use margin levels to determine whether you can open additional positions.

15

56 reads

What is a Margin Call?

In forex trading, the Margin Call is when the Margin Level has reached a specific level or threshold.

When this threshold is reached, you are in danger of the POSSIBILITY of having some or all of your positions forcibly closed (or “liquidated“).

If the Margin Level in your account falls to 100% or lower, a “Margin Call” will occur.

A Margin Call is when your broker notifies you that your Margin Level has fallen below the required minimum level (the “Margin Call Level”).

A Margin Call occurs when your floating losses are greater than your Used Margin.

15

57 reads

What is a Stop Out Level?

The Stop Out Level is when the Equity is lower than a specific percentage of your Used Margin.

This liquidation happens because the trading account can no longer support the open positions due to a lack of margin.

If this level is reached, your broker will automatically start closing out your trades starting with the most unprofitable one until your Margin Level is back above the Stop Out Level.

If your Margin Level is at or below the Stop Out Level, the broker will close any or all of your open positions as quickly as possible in order to protect you from possibly incurring further losses.

15

53 reads

Different Forex Brokers Have Different Margin Call and Stop Out Levels

Each retail forex broker or CFD provider sets their own Margin Call Level and Stop Out Level.

Depending on the broker, a “Margin Call” can be one of two things:

- If there is a separate Stop Out, your broker sends you a warning that your account equity has dropped below the required Margin Level percentage, There is no Equity to support your open positions any further.

- If there is no separate Stop Out, your broker automatically closes your trades, starting from the least profitable one until the required Margin Level is met.

15

51 reads

Overleveraging

Margin Calls and Stop Outs occur due to overleveraging. Using more leverage can increase your gains, but it can also increase losses, which will quickly deplete your Free Margin. The more leverage you use, the faster your losses can accumulate.

15

54 reads

The Relationship Between Margin and Leverage

You use margin to create leverage.

Leverage allows you to trade positions LARGER than the amount of money in your trading account.

Leverage is the ratio between the amount of money you really have and the amount of money you can trade.

When a trader opens a position, they are required to put up a fraction of that position’s value “in good faith”. In this case, the trader is said to be “leveraged”.

The “fraction” part which is expressed in percentage terms is known as the “Margin Requirement”.

15

51 reads

How to Avoid a Margin Call

Here are five ways to avoid a margin call.

- Know a margin call is.

- Know what the margin requirements are even before you place ANY order.

- Use stop loss or trailing stops to avoid margin calls.

- Scale in positions rather than entering all at once.

- Know what you are doing as a trader.

Risk management should be your main priority, not profits.

Know when to cut your losses so you can trade another day.

16

58 reads

IDEAS CURATED BY

CURATOR'S NOTE

I want to make summary of what I have learned about Forex so that I can refresh it again.

“

Similar ideas

15 ideas

Learning Forex (Preschool) - Who Trades Forex?

babypips.com

30 ideas

3 ideas

Learning Forex (Preschool) - Why Trade Forex?

babypips.com

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates