MAKE EPIC MONEY

Curated from: amazon.in

Ideas, facts & insights covering these topics:

14 ideas

·26.2K reads

57

2

Explore the World's Best Ideas

Join today and uncover 100+ curated journeys from 50+ topics. Unlock access to our mobile app with extensive features.

They mislead us all

We are told since childhood that the proven process for achieving financial security is-

- Study hard

- Get a job

- Work hard

- Get promoted

- Earn well

- Live happily ever after.

But most people in the world are following the same process and we already know that the majority are not wealthy instead, they are poor. So this process cannot be a method to be financially secure or free.

We need to think and reflect on this "No one, school, college, course can teach you everything about money, they can teach you about how to earn a living."

129

1.77K reads

Singer Rihanna nearly went bankrupt after overspending. She then sued her financial adviser.

Adviser: Was it really necessary to tell her that if you spend money on things, you will end up with the things and not the money.

MORGAN HOUSEL.

135

1.76K reads

Can Money Buy HAPPINESS?

--not directly but it can buy you some other things that can lead you to the path to happiness-

- Peace of mind as your bills, fee, & EMIs are taken care of.

- Quality food, it's already a luxury. Junk food is cheap for a reason.

- Safety by having own transport, safe neighborhood, afford security.

- Options to choose from this college or that, this job or that, Holiday or continue to grind oneself.

- Comforts like quality mattresses, good shoes, warm clothes, heating, air conditioning, cool gadgets.

- Courage to take risks, avoid fear of failure.

- Happy family.

- Experiences like travel, concerts.

- Freedom t

o choose .

152

1.46K reads

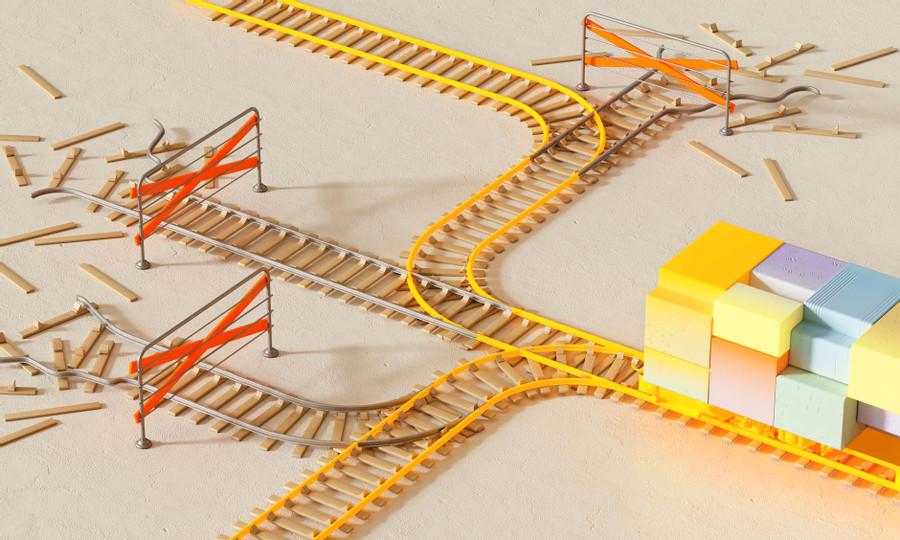

Set up multiple income streams

- Use the skills you have to start an agency and hire folks to manage that.

- If you are a content creator, build your audience on a platform and run ads, affiliates & sponsorships.

- If you've got expertise in something, record the lessons once and make a self-paced course about that.

- If you're on a property train, and have some spaces, either rent them or invest in REITs.

- If your skills include creativity, you can earn royalties.

The trick is to try new things you can and stay curious.

160

1.44K reads

Don't Spend Less, Spend Right

Try this 50:30:20 rule.

Break down your income after tax -

- 50% on basic needs,

- 30% on wants/desires/things you love,

- 20% on savings, to invest.

Reflect on the 'why' before you 'buy'.

Stay away from bad debt.

Clear your loans faster (either by paying extra EMIs per year or by increasing your EMIs every year).

Saving is not s*xy, but we should save for emergencies and our dreams.

Savings give you the ultimate F*ck-you power (The power to walk away from a job you hate, to handle a medical emergency without deleting your reserves, to move into your place, and the power to live life on your terms.

157

1.3K reads

Insurance is like a parachute; if you don't have it the first time you need it, you won't need it again.

RDX KAUSHIK.

136

1.38K reads

True Financial Independence

- When income from your investments, pays for your needs and expenses. For life!

- When you work because you want to, not because you have to.

- When you have money to live well, even without the 9 to 5 grind.

141

1.31K reads

Understanding of Asset Classes

- Low Risk- FDs, PF and NPS, and Gold.

- Medium Risk- Corporate Bonds, Real Estate, Mutual Funds.

- High Risk- Stock Market Trading, Cryptocurrency, etc.

148

1.36K reads

The System wants you to make MISTAKES

Learn from the mistakes of others-

- Risk can't be eliminated. It can only be understood and managed.

- Live well, today. Also, live responsibly. Make Budget.

- Don't ignore inflation. It is the silent money eater.

- Don't ignore the taxes too.

- Do not spend money that you do not have.

- The ego is like your 'social media filter'. The 'INSTA you' versus the 'Raw, unfiltered you'.

- Understand the dark side of compounding too.

- Be aware that most purchases have a hidden cost.

- Don't rely on a single job.

- Create a margin of safety.

- The fastest way to become wealthy is to go slow. The earlier you start, the better.

160

1.2K reads

Our Biases decide for us Unconsciously

Numbers don't drive money decisions, Our biases do, and our emotions do.

Our emotions make us do some very stupid things. I know that we are all prone to biases that we don't even know we have. Sellers capitalize on this, so no choice is presented neutrally. For example-

Cognitive Bias- FRAMING EFFECT.

It means no information is presented neutrally. Given 2 Options, we'll always pick a story we like.

Assume, You are in a supermarket, and see a delicious product there, its packing says

- 70% Fat-Free

- 30% Fat

Most of us choose option 1 but see, these both are the same things but presented differently.

141

1.02K reads

More Biases

It was quite interesting reading about these cognitive biases, this book has mentioned 13 biases. These are very thought-provoking, I researched and found a book that has given some more details about 100 such Biases with daily life examples, and how to overcome them just by thinking critically named

THE BIASED LENS (100 Cognitive Biases with their daily life examples and ways to overcome them)

I recommend you go and understand around 100 biases in that book, and I assure you that you will not be the same as you are now.

142

953 reads

IDEAS CURATED BY

CURATOR'S NOTE

This book is by an Indian Author "Ankur Warikoo". He has been terrible with his money management nearly all his life. This was because he was never taught anything about money. All that he was taught was how to earn a living. So he set out to write this book for his younger self, sharing everything he had been taught while adulting. It is practical, has no technical jargon, and teaches how to earn, spend, and put money to work.

“

Similar ideas

7 ideas

The Personality Almanac

amazon.in

7 ideas

Normal To Noble

amazon.in

11 ideas

The Palette of Life/Arts

amazon.in

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates