Don't Spend Less, Spend Right

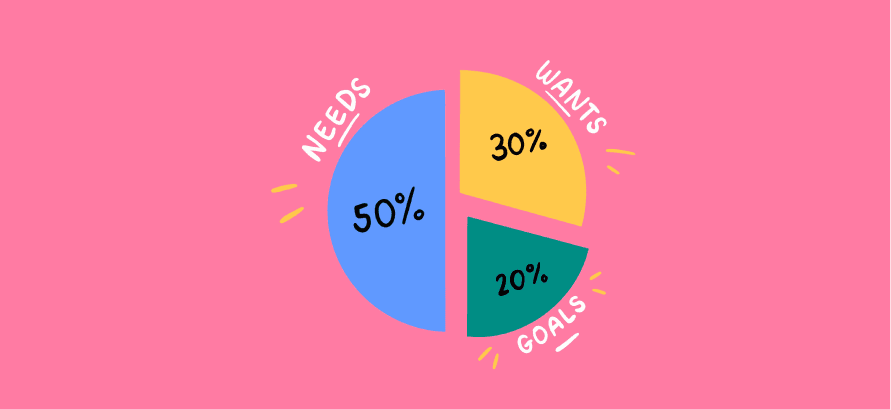

Try this 50:30:20 rule.

Break down your income after tax -

- 50% on basic needs,

- 30% on wants/desires/things you love,

- 20% on savings, to invest.

Reflect on the 'why' before you 'buy'.

Stay away from bad debt.

Clear your loans faster (either by paying extra EMIs per year or by increasing your EMIs every year).

Saving is not s*xy, but we should save for emergencies and our dreams.

Savings give you the ultimate F*ck-you power (The power to walk away from a job you hate, to handle a medical emergency without deleting your reserves, to move into your place, and the power to live life on your terms.

157

1.3K reads

CURATED FROM

IDEAS CURATED BY

This book is by an Indian Author "Ankur Warikoo". He has been terrible with his money management nearly all his life. This was because he was never taught anything about money. All that he was taught was how to earn a living. So he set out to write this book for his younger self, sharing everything he had been taught while adulting. It is practical, has no technical jargon, and teaches how to earn, spend, and put money to work.

“

Similar ideas to Don't Spend Less, Spend Right

The 50-20-30 rule

It is a budget rule to help people reach their financial goals. It states that:

- You should spend up to 50% of your after-tax income on needs and obligations that you must-have or must-do.

- The remaining half should be split up between 20% savings and debt repayment and 30% to ev...

How much you should save every month

The popular 50/30/20 rule states that you should reserve 50 percent of your budget for essentials like rent and food, 30 percent for discretionary spending, and 20 percent for savings.

But it's not that simple. If you're a high earner, you'd be wise to save a larger percentage of your inco...

7. Save $1000

An emergency fund simplifies everything. If you are paying off debt, only pay your minimum payments until you can save $1000. If you aren’t in debt, but still spend what you have, set aside money every day or every week until you reach $1000. Matt D'vella, a famous minimalist and productivity you...

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates