Explore the World's Best Ideas

Join today and uncover 100+ curated journeys from 50+ topics. Unlock access to our mobile app with extensive features.

Investing is for everyone

Investing is not magic. Remember that ...

- most people don't invest at all

- 75% of new traders quit within the first 3 months.

- 90% of new traders quit within the first 6 months.

If you can stick around long enough and keep learning, you will be successful at this game. Learn the basics and practice.

2.64K

19.5K reads

Stock Exchanges

It's where shares in companies are traded. The most important ones are:

- NYSE (New York Stock Exchange) - known for "blue chip" stocks like Coca-Cola . Companies here are identified by 2 letters tickets (KO for Coca Cola)

- NASDAQ - known for tech stocks like Apple. The tickets here are usually made of 4 letters (AAPL for Apple)

To trade on a stock exchange you need to use a "broker", a middleman: Fidelity, Robinhood etc

2.45K

12.9K reads

The technicality of buying a stock

Every stock has a bid price and an offer (or "ask") price. “You sell to the bid, and you buy from the ask.”

When you are buying a stock, you can use 2 different kinds of orders:

- market order: this order tells the broker to get you into the stock as quickly as possible, regardless of price.

- limit order: specifies a price.

2.43K

12.4K reads

Trading ETFs (exchange-traded fund")

An index is simply a collection (or "basket") of stocks. An ETF allows trading an index just like a stock. The best-known indexes are:

- S&P 500 (trading as SPY): the 500 U.S. stocks with the largest market caps

- Dow Jones Industrial Average (trading as DIA): It always contains only 30 very large and well-known companies.

- Nasdaq 100 (trading as QQQ): contains the most valuable 100 US tech companies.

Indexing is widely considered the safest and best way for most people to invest.

2.51K

9.83K reads

2.36K

10.9K reads

Active vs Passive Investing

Active investing strategies means picking your own stocks and building and managing a portfolio. It's hard and few people do it well.

Passive investing strategies mean investing in an index. When indexing, most people like to invest the same dollar amount of money into an index every month. By buying an index/ETF at different times, you end up getting a pretty good "average price.” This practice is called "cost averaging.”

2.45K

9.33K reads

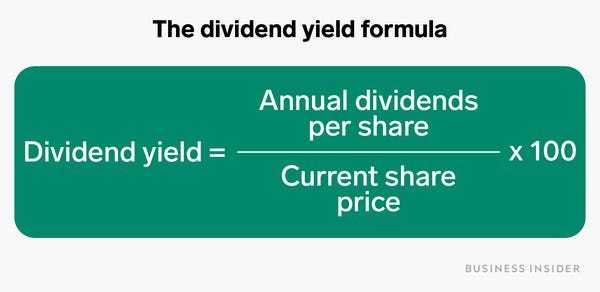

Dividend Stocks

A dividend stock will usually make a cash payment into your brokerage account every 3 months. Works well as you can take the cash from a dividend payment and use it to buy more dividend stocks.

A dividend yield is how much money you make yearly compared to the share price (see image): If you paid $60/share and get $1.8 in dividends/year you have a 3% yield.

Usually, yields should be better than interests on savings, but as opposed to a bank account, the value of the stock could go down.

2.48K

8.08K reads

Value Investing

Popularized by investors Benjamin Graham & Warren Buffett, value investing is about buying something for less than it is worth. It's based on this idea that you can find undervalued companies (companies with low P/E - price per earnings). It's hard to do it these days:

- Finding undervalued companies can be confused with finding cheap companies. Companies that are in trouble often have P/E's below 10.

- The fastest-growing tech companies have huge P/E ratios. The good companies are not cheap.

2.45K

7.52K reads

P/E Ratio (Price per Earning)

Let's say that a company's stock trades for $100 and that the company has earnings per share (EPS) of $6.50 over the last 12 months.

We can calculate a trailing ("last 12 months") P/E ratio for that stock by simply dividing the stock price ("P") by the EPS ("E"), so 100/6.50 equals about 15.

We can say that this stock has a TTM P/E (trailing 12 months price to earnings ratio) of 15. Historically that is a pretty good average P/E for stock or for the stock market as a whole.

2.5K

6.94K reads

Growth Stocks

Great companies that are rapidly growing will always trade at high P/E's (Facebook, Amazon etc). Value investors will always tell you to stay away from companies with high P/E's. Ignore them.

Matthew's advice: buy growth stocks that are hitting new 52-week highs, or even all-time new highs. Why?

- Every single holder of the stock has a profit. Except the short-sellers who are now forced to sell at a loss. And they push the price even higher.

- A growing stock gets publicity and more people invest, pushing the price even higher.

2.5K

6.61K reads

How to find growth stocks

Find stocks with the following characteristics:

- price at 52wk highs or new all-time highs

- stock is trading above its 50day moving average and the 50day moving average is above the 200day moving average

- trends upwards after a earning report

- markets are up (using the same 50 and 200-days formula as for the stock)

- a market cap of $5 billion or less. (it takes a lot less money to push a $5 billion stock higher than it does a $500 billion market cap stock)

- the float (the number of shares of a stock that are actually available for trading) is less than 20% of the total number of shares outstanding.

- high short interest (the quantity of shares that have been sold short by those who believe that the stock will go down)

2.78K

5.75K reads

When to sell a growth stock

Get out:

- when a stock moves up 100% in 2 weeks or less

- when you are up 300% from your entry price

- when all of your friends and CNBC begin to talk a lot about it

- when the stock closes below its 50day or 200day moving average

- when the stock has a daily close below EMA (10-day or 20-day exponential moving average )

You can scale out of a profitable position. Sell 25% of your position every Monday for 4 weeks in a row.

2.71K

6.13K reads

How much to invest in growth stocks

Risk no more than 1% of the trading account on each stock trade.

Let’s say that I am trading a $100,000 account. I will risk only 1% of my account, or $1,000. If I enter the stock at 100 and the 50-day moving average is at 95, that means that my risk is 5 points on the stock (100-95). In that case, I should only buy 200 shares of stock. If I buy 200 shares of stock, and the stock falls 5 points, I will have lost $1,000 or just 1% of my total account size.

The key to making a lot of money is not losing a lot of money in the process.

2.55K

5.29K reads

The big 5 beginner investing mistakes

- Don’t buy stocks that are hitting 52-week lows. You are most likely catching a falling knife.

- Don’t trade penny stocks. They are mostly scams.

- Don’t short stocks. You will probably get burned.

- Don’t trade on margin. Don't borrow to buy stocks. You may lose your house.

- Don’t trade other people’s ideas. They probably don’t know what they are doing.

2.59K

6.99K reads

IDEAS CURATED BY

Life-long learner. Passionate about leadership, entrepreneurship, philosophy, Buddhism & SF. Founder @deepstash.

Curious about different takes? Check out our A Beginner's Guide to the Stock Market Summary book page to explore multiple unique summaries written by Deepstash users.

Vladimir Oane's ideas are part of this journey:

Learn more about books with this collection

How to manage risk

How to analyze investment opportunities

The importance of long-term planning

Related collections

Different Perspectives Curated by Others from A Beginner's Guide to the Stock Market

Curious about different takes? Check out our book page to explore multiple unique summaries written by Deepstash curators:

15 ideas

Prince Rahul's Key Ideas from A Beginner's Guide to the Stock Market

Matthew R Kratter

Discover Key Ideas from Books on Similar Topics

8 ideas

5 Differences between Investing and Trading

motilaloswalmf.com

9 ideas

Best Investing Strategies | Millennial Money

millennialmoney.com

4 ideas

Investing in One Lesson

Mark Skousen

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates