Do stocks only go up?

We took the data set from the SP500 Yahoo Finance Historical Data and tested it.

We only had open and close data from 1982 and after.

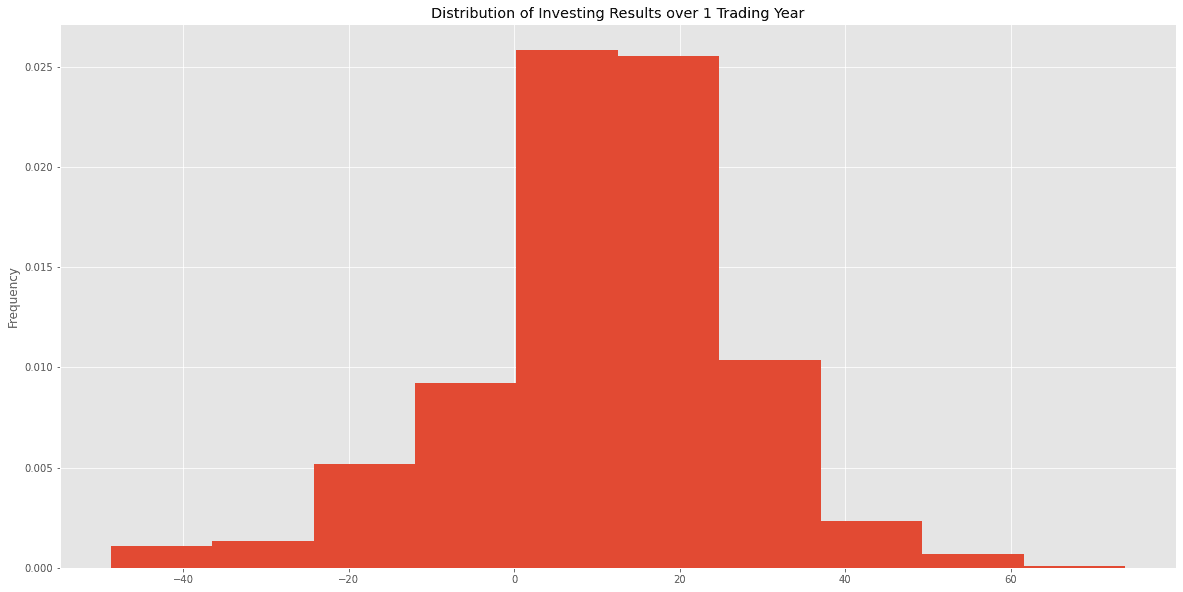

Methodology: Rather than measuring calender years, we measured trading years on a daily basis. Every day of every year we looked back 1 trading year and measured the results.

Results:

Over 9930 Periods, 7727 of periods the SP500 was higher than the same day in the previous trading year. It was never the exact same. 1950 it was lower.

Mean returns were 10.6%

Median returns were 11.96%

1

16 reads

IDEAS CURATED BY

Interest in Programming, Data Science and Investments. Love discussing economics and behavioral psychology.

Steven Harrison's ideas are part of this journey:

Learn more about moneyandinvestments with this collection

How to create and sell NFTs

The future of NFTs

The benefits and drawbacks of NFTs

Related collections

Similar ideas

9 ideas

The Psychology of Money

Morgan Housel

5 ideas

The Psychology of Money

Morgan Housel

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates