5.

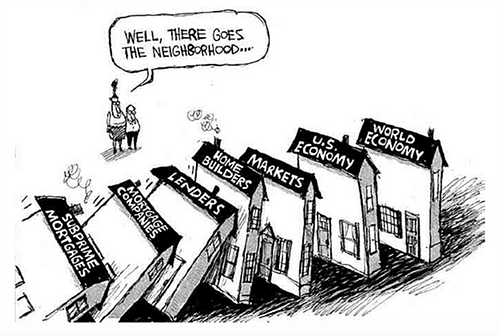

Investors were unaware of the fact that they had been provided loans on an adjustable-rate of 1% (the interest of loan increases over time). When the interest rates increased, people started defaulting loans.

1

0 reads

CURATED FROM

IDEAS CURATED BY

An artist, writer, storyteller too and Entrepreneur. Founder of Formaculture, a young community for young ideas and socio entrepreneur, a science student with a finance community - WEALTHONOMY.

The idea is part of this collection:

Learn more about crypto with this collection

Find out the challenges it poses

Learn about the potential impact on society

Understanding the concept of Metaverse

Related collections

Similar ideas to 5.

Loan

A Loan involves an agreement to let the borrower use a certain amount of resources for a certain period of time. In exchange, the borrower must pay the lender a series of payments over a predefined period of time, which is equal to the original loan plus a predefined interest rat...

Save On Debts

Refinance your home or automobile at a lower rate to save money over the life of the loan and lower your monthly payment.

If your student loans are locked in at a high-interest rate, figure out whether it makes sense to consolidate all or some of them.

Poloniex

This is a popular altcoin exchange which offers leveraged trading and has a peer-to-peer market for users who want to provide liquidity to margin traders and earn daily interest as a result. You can set your own interest rate and loan duration, and because these are short term loans with daily in...

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates