Explore the World's Best Ideas

Join today and uncover 100+ curated journeys from 50+ topics. Unlock access to our mobile app with extensive features.

Introduction

If the Financial Crisis has put you into a dilemma of knowing about it in bits and pieces, read this article for getting yourself well-versed with it.

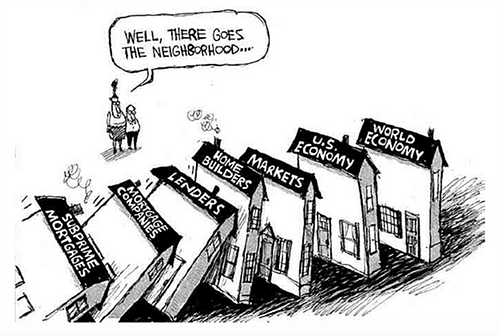

Here in this article, the main reasons that led to the Great Financial Crisis of 2008 are explained and what devastating effects it had on the economy. How the background and the factors developed over time which ultimately resulted in a catastrophe.

1

1 read

1.

In 1996, the US was witnessin g a DotCom bubble that burst in 2000–02, and the prices of technological companies came down. In 2001, the interest rates came down to 1% so people were unwilling to keep money in the bank. Investors found real estate lucrative and took home loans to buy houses for themselves.

1

0 reads

2.

The bank started giving loans to people with appropriate collateral security which they sold it to Investment Bank further for a fixed commission. Now, investment banks bundled these loans to form a complex derivative called CDO ( Collateralized Debt Obligation).

1

0 reads

3.

CDOs were rated from credit rating agencies which helped them built authenticity and sold them to investors. Now, Investment banks demanded more loans from banks which induced the banks to provide sub-prime loans.

1

0 reads

4.

AIG, being the world’s largest insurance company started giving insurance to CDOs, known as Credit Default Swap (CDS) as they were rated AAA so the chances of failure were bleak.

1

0 reads

5.

Investors were unaware of the fact that they had been provided loans on an adjustable-rate of 1% (the interest of loan increases over time). When the interest rates increased, people started defaulting loans.

1

0 reads

6.

As there was little or no down payment for the loan provided, banks started selling houses to recover the amount of loan. When banks started selling houses, there were no buyers and the price of houses fell drastically. Ironically, the amount of loan was higher than the value of the house mortgaged.

1

0 reads

7.

Fund managers who knew the reality of CDOs insured it and gained huge amount of money. Due to this, people stopped buying CDOs, and Investment Banks which have collected them were running in losses. Every participant forming a part of the chain was now suffering losses.

1

0 reads

IDEAS CURATED BY

An artist, writer, storyteller too and Entrepreneur. Founder of Formaculture, a young community for young ideas and socio entrepreneur, a science student with a finance community - WEALTHONOMY.

Harsha T R's ideas are part of this journey:

Learn more about crypto with this collection

Find out the challenges it poses

Learn about the potential impact on society

Understanding the concept of Metaverse

Related collections

Similar ideas

3 ideas

Financial Crisis Definition

investopedia.com

3 ideas

Everything you need to know About DeFi Loans

101blockchains.com

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates