Buying The Low

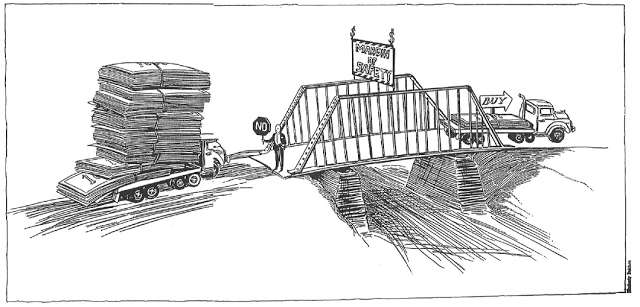

Human nature is a powerful force, but it deludes us to believe our gut instincts. When the price of an asset falls to a level where an investor or trader believes is a logical, reasonable, and rational low, they perceive the price as a bargain.

After an initial purchase, if the price continues to fall, our emotions cause a dangerous impulse. The little voice in our heads (ego) declares that the market is wrong. But it's never wrong.

The quest to buy the low in any market has everything to do with ego and little to do with making a profit.

17

58 reads

CURATED FROM

IDEAS CURATED BY

Passionate about crypto Trading since 2015 M.Sc. Chemical engineering Soon Ph.D. Computer science

The idea is part of this collection:

Learn more about psychology with this collection

Identifying and eliminating unnecessary expenses

How to negotiate better deals

Understanding the importance of saving

Related collections

Similar ideas to Buying The Low

The Intelligent Investor vs The Speculator

The investor believes that the market price is judged based on the established standards of value, while the speculator bases all their judgment on market price.

To distinguish whether you are the intelligent investor or a speculator, ask yourself whether or not you would invest in a stock...

Margin of Safety

This is a principle of investing wherein an investor purchases securities only when their market price is significantly below their intrinsic value.

The formula to determine the intrinsic value of something is:

Margin of Safety = Market Cap / Deep Value Barg...

The technicality of buying a stock

Every stock has a bid price and an offer (or "ask") price. “You sell to the bid, and you buy from the ask.”

When you are buying a stock, you can use 2 different kinds of orders:

- market order: this order tells the broker to get you into the stock...

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates