3. Keep your credit card balance as low as possible

This is the worst misuse of money ever sure I'll just put it on my credit card I'm never going to pay it back

36

566 reads

CURATED FROM

IDEAS CURATED BY

What's up, it's @hackedongrowth here, so let's be honest with ourselves: we all want to do better with our money, whether it's generating more money or building our wealth; it's all about the incremental changes we make along the path, and most people, sadly, will not follow these very basic five steps.

“

The idea is part of this collection:

Learn more about personaldevelopment with this collection

How to set achievable goals

How to prioritize self-care

How to create healthy habits

Related collections

Similar ideas to 3. Keep your credit card balance as low as possible

Credit Card Debt

The trickiest form of debt, which is literally bleeding our finances, is the credit card debt. Make sure you know what the interest rate being charged is. Know that a 2% interest rate per month is actually 24% per annum.

If you stay out of debt by paying the total due on t...

The Birth Of The Credit Card

- The concept of a multiple-establishment credit card came in the mind of Frank X. McNamara in 1949, when he had forgotten his wallet and was unable to pay for his dinner at a fancy restaurant, where he was dining with his relatives.

- Store-specific credit accounts were used at that t...

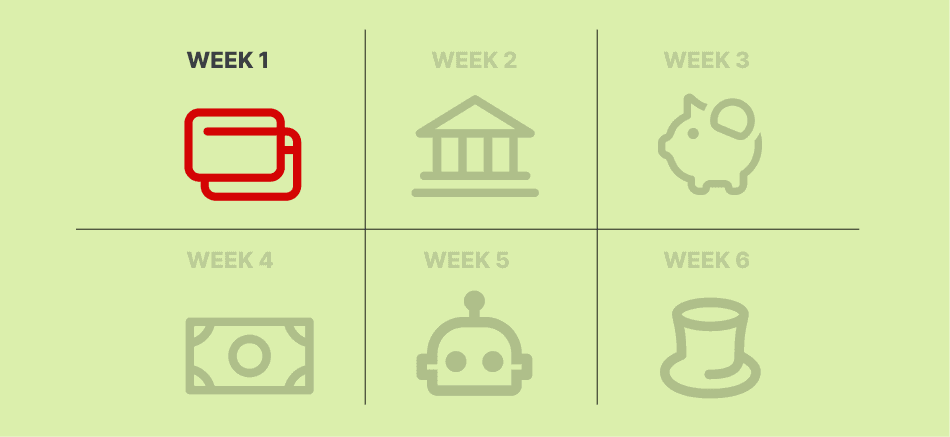

Week 1: Optimize Your Credit Cards

A great place to start because it can have a big impact on your finances:

- Set up autopay to pay your CC bills

- Call to waive any past credit card fees

- Negotiate a lower APR

- Build credit history by keeping credit lines open

- Increased your credit allowance

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates