Worried About Investing?

Rent, utility bills, debt payments and groceries might seem like all you can afford when you're just starting out. But once you've mastered budgeting for those monthly expenses (and set aside at least a little cash in an emergency fund), it's time to start investing.

The tricky part is figuring out what to invest in — and how much.

As a newbie to the world of investing, you'll have a lot of questions, not the least of which is: How do I get started, and what are the best investment strategies for beginners?

Here's what you should know to start investing.

7

45 reads

CURATED FROM

IDEAS CURATED BY

"I can do all things through Christ who strengthens me.” — Philippians 4:13

Learning the basics about investing can be pretty complicated and overwhelming without the proper information. Hopefully this guide can help you get started.

“

The idea is part of this collection:

Learn more about moneyandinvestments with this collection

How to manage risk

How to analyze investment opportunities

The importance of long-term planning

Related collections

Similar ideas to Worried About Investing?

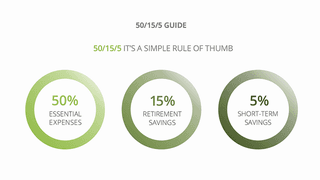

The 50/15/5 rule for multiple financial goals

- 50% of your income goes toward essential expenses: rent, bills, minimum debt payments.

- 15% percent goes to retirement savings. They also suggest you increase this by 1% each year.

- 5% goes toward unexpected monthly expenses or building an emergency...

Needs, wants and savings

- Needs: these are those bills that you absolutely must pay and are the things necessary for survival (rent or mortgage payments, car payments, groceries, insurance, health care, minimum debt payment, and utilities).

- Wants: these include all the things...

Budgeting your money is the cornerstone of a sound financial plan, and seeing all the numbers in black and white can offer valuable perspective on where your mone...

WES MOSS

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates