Budgeting your money is the cornerstone of a sound financial plan, and seeing all the numbers in black and white can offer valuable perspective on where your money is going and where you could put it to better use.

- Gather into one place all your electronic or paper bills, receipts, pay stubs, bank statements , and any other record of income or expense for at least a month. Or keep track of monthly income and expenditures as they happen.

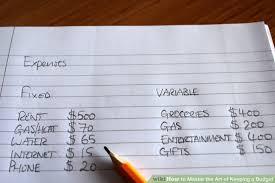

- Create a budget worksheet , using a budget template from Google Sheets , an Excel spreadsheet, or paper and pen. List all your income after taxes—for example, employee and freelance income, investment income, and interest earned on any savings accounts. Then list all expenses—for example, rent or mortgage payments, credit card payments, installment loan payments, grocery receipts, and utility bills.

- Add up each set of figures and subtract the expense total from the income total to get a general picture of your financial health. If your income total is larger than your expense total—congratulations—you just found more money for saving, investing, and paying down your debt. If your expense total is larger than your income total, all is not lost, but you'll have to make some choices about where you spend some of your money going forward if you want to balance your budget.

- Drill down into your expenses and further categorize them into fixed, variable, and discretionary expenses . Fixed expenses (such as your rent) remain the same from month to month and thus often constitute the basis of your budget. Variable expenses such as utility bills can typically be lowered with behavioral tweaks like turning off the lights as you leave a room, and discretionary expenses consist of wants rather than needs and provide the most opportunities for saving.

WES MOSS

20

179 reads

The idea is part of this collection:

Learn more about moneyandinvestments with this collection

How to build trust and respect with team members

How to communicate effectively

How to motivate and inspire others

Related collections

Similar ideas

Make a Budget in 6 Simple Steps

- Gather every financial statement you can (bank statements, investment accounts, recent utility bills).

- Record all of your sources of income.

- Create a list of monthly expenses.

- Break expenses into 2 categories: fixed and variable.

Keeping The Budget

Compare the total monthly family income with total monthly expenditures. If you have excess money after paying your bills you can save or invest it, otherwise, you have to reduce expenses, increase revenue, or do both.

Analyze your monthly expenses, and set priorities in spending. After ...

How to create a budget

- Gather Some Financial Information: gather a detailed list of your income and expenses.

- Select a Budgeting Method: figure out how you’ll budget your money to meet your most pressing financial goals.

- Create Your Budget: tally...

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates