4.

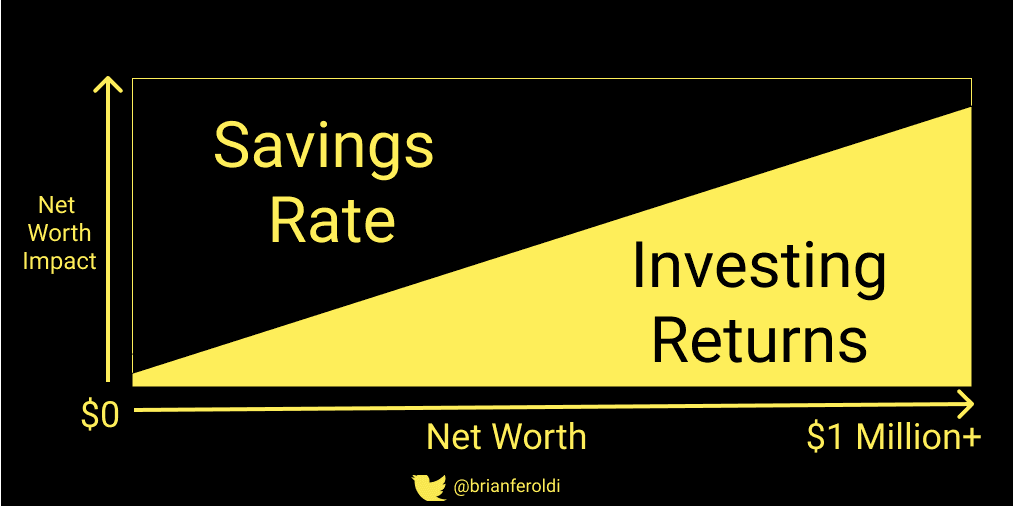

In the beginning, focus the vast majority of your effort on boosting your income & savings rate

49

410 reads

CURATED FROM

10 critical investing lessons I wish I could teach my younger self

mobile.twitter.com

10 ideas

·4.24K reads

IDEAS CURATED BY

I've been investing for 18+ years I've made TONS of mistakes along the way here are 10 critical investing lessons I wish I could teach my younger self:

“

The idea is part of this collection:

Learn more about moneyandinvestments with this collection

How to apply new knowledge in everyday life

Why continuous learning is important

How to find and evaluate sources of knowledge

Related collections

Similar ideas to 4.

Save Money

Building wealth has little to do with your income or investment returns and more to do with your savings rate. The value of wealth is relative to what you need. A high savings rate means having lower expenses than you otherwise could, and having lower expenses means your savings ...

20%: Savings

Finally, try to allocate 20% of your net income to savings and investments. This includes adding money to an emergency fund in a bank savings account, making IRA contributions to a

Personal Finance: Wealth Creation

Savings = Income - Expenditure, i.e. increase your income & decrease your expenditure to increase savings.

Follow budgeting principle:

- Needs: 50% of Total Income,

- Wants: 30% of Total Income,

- Savings: 20% of Total Income.

Smart ways to save more:

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates