10 critical investing lessons I wish I could teach my younger self

Curated from: mobile.twitter.com

Ideas, facts & insights covering these topics:

10 ideas

·4.24K reads

16

1

Explore the World's Best Ideas

Join today and uncover 100+ curated journeys from 50+ topics. Unlock access to our mobile app with extensive features.

1.

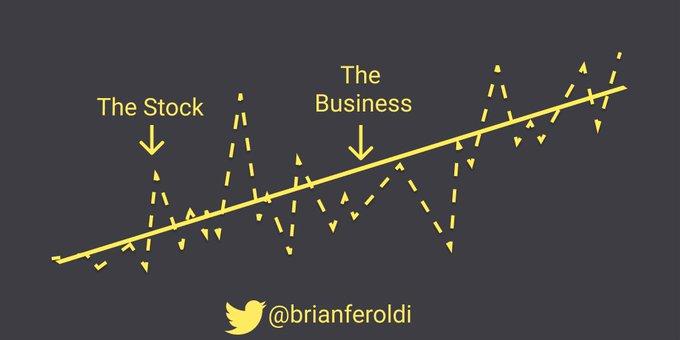

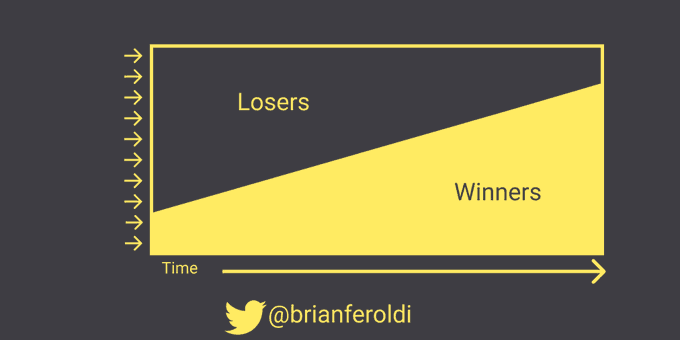

Stock prices & business profits are not at all linked in the short-term, but they are 100% linked in the long-term

Watch the business, not the stock

49

649 reads

2.

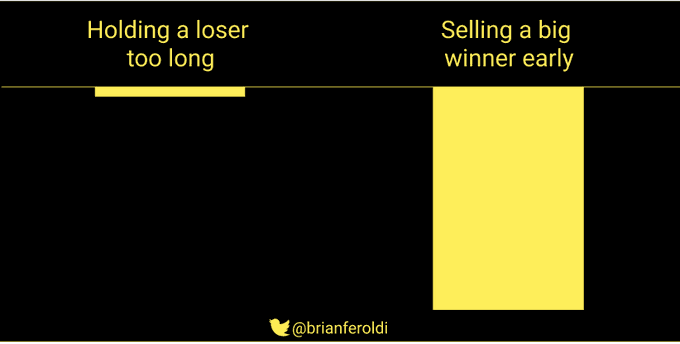

It's a FAR bigger mistake to sell a mega-winner early than it is to hold a mega-loser too long.

49

590 reads

3.

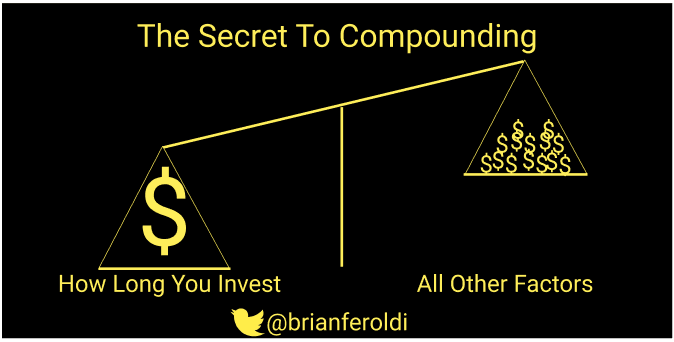

Compounding pays off the most in the out-years

Optimize for longevity first, everything else second

46

439 reads

4.

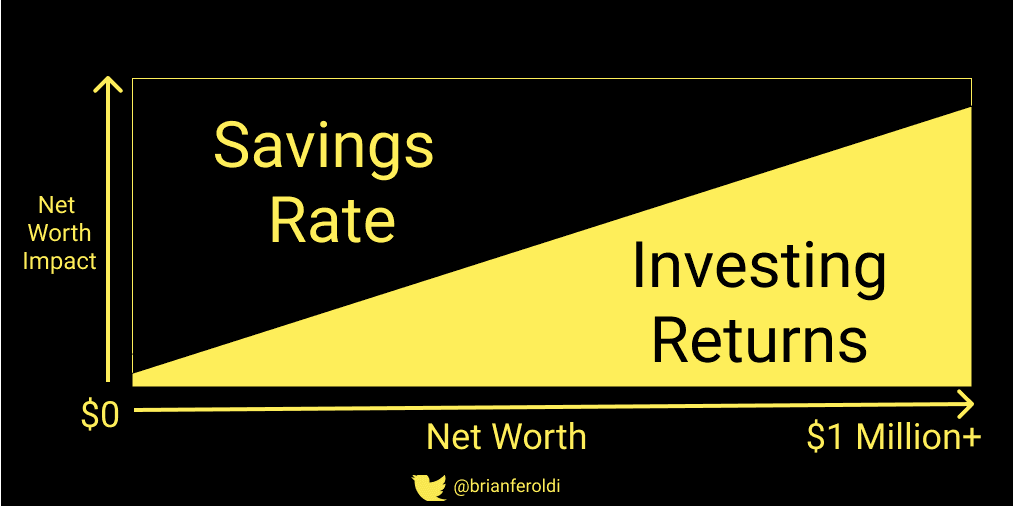

In the beginning, focus the vast majority of your effort on boosting your income & savings rate

49

410 reads

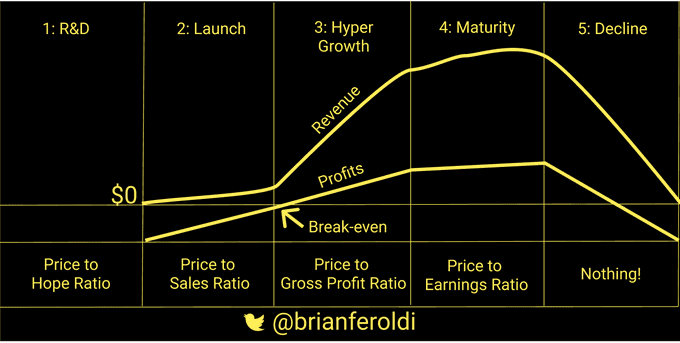

6.

The P/E ratio is only useful when a company is fully optimized for profits (stage 4)

It's most deceiving in stages 3 & 5

49

374 reads

IDEAS CURATED BY

CURATOR'S NOTE

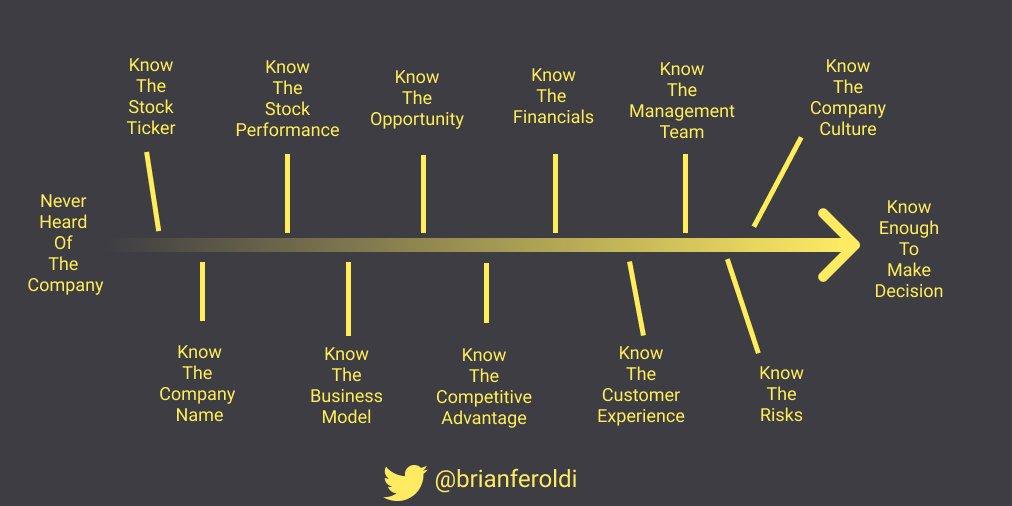

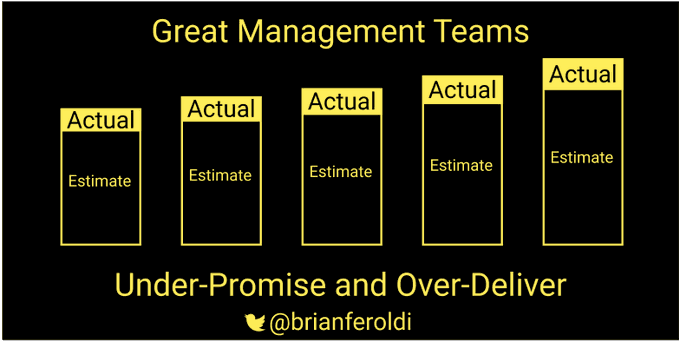

I've been investing for 18+ years I've made TONS of mistakes along the way here are 10 critical investing lessons I wish I could teach my younger self:

“

Ashish R's ideas are part of this journey:

Learn more about moneyandinvestments with this collection

How to apply new knowledge in everyday life

Why continuous learning is important

How to find and evaluate sources of knowledge

Related collections

Similar ideas

12 ideas

3 ideas

10 ideas

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates