Cause and Effect

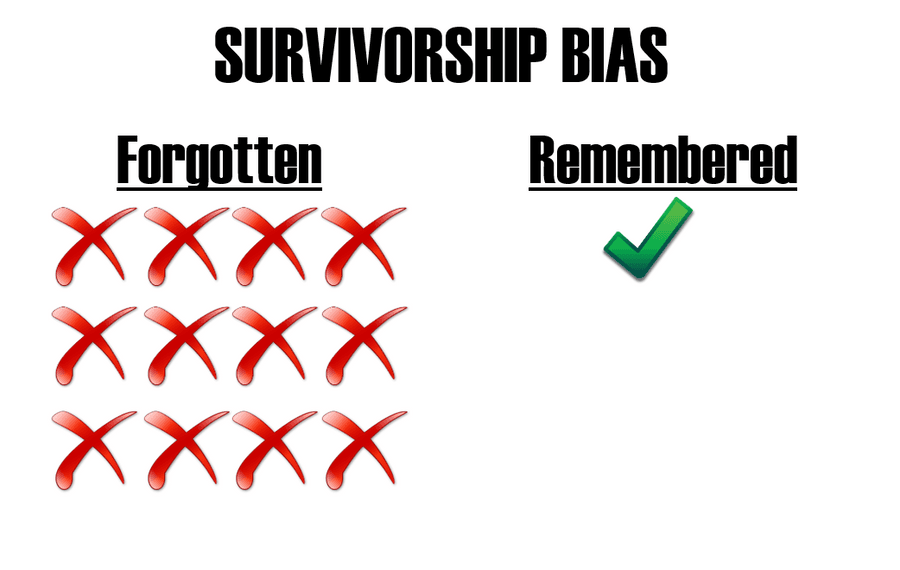

Survivorship bias leads us to think that coincidence is a correlation. We want the encouragement from survivorship bias so we can believe in our own capabilities, but it results in an inflated idea of how people become successful.

The fact is that success is never guaranteed. It does not mean that we shouldn't try, just that we should have a realistic understanding.

101

205 reads

CURATED FROM

IDEAS CURATED BY

For every question, there is an answer. For every problem, there is a solution. For everything else, there is an explanation.

The idea is part of this collection:

Learn more about problemsolving with this collection

How to set new goals

How to take action towards a new life

How to create a plan for change

Related collections

Similar ideas to Cause and Effect

Survivorship Bias

Survivorship bias is a logical error that twists our understanding of the world and leads to a wrong understanding of cause and effect.

We fall into survivorship bias when we assume that success stories tell the entire story of a product/business, while we don't properly consider past fail...

The Survivorship Bias

We tend to be interested in the success stories of many. We love the encouragement it provides us, but we often overlook the fact that most of these success stories have undergone through many failures.

Survivorship bias is when we concentrate on the peopl...

Why Change Is So Hard

Changing is necessary and takes energy but our brains tend to try to conserve energy as much as possible. So we have mental biases that influence our behaviors and make us shy away from opportunities—even when they benefit us in the long-term.

Two of the main bias are loss aversion a...

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates