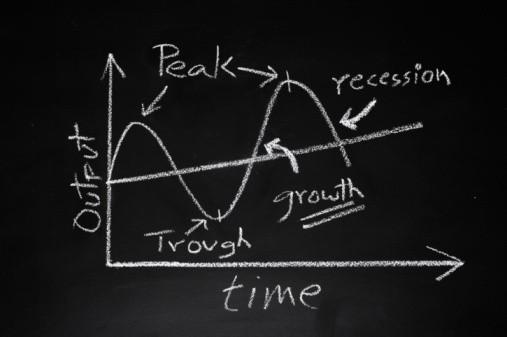

Periods of high growth and low growth

Periods of high growth and low growth are not uncommon. For example, look at how the world went from the great 1920s to the Great Depression in the 1930s.

Investor Howard Marks discusses the concept of cycles in his book, Mastering The Market Cycle. He states that the economy grows, on average, at a consistent pace. The economy will get stimulated and make people take more risks and consume more. In turn, this period often causes inflation and slows things down.

Recessions and slowdowns are normal. However, when you invest long-term, these fluctuations won’t harm you.

12

125 reads

CURATED FROM

IDEAS CURATED BY

The idea is part of this collection:

Learn more about mentalhealth with this collection

How to develop a healthy relationship with money

How to create a budget

The impact of emotions on financial decisions

Related collections

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates