Quantitative easing

In recent decades, central banks have tried quantitative easing to infuse the economy with cash while maintaining a low risk of severe inflation. The quantitative easing approach is where a central bank increases cash flow by purchasing another entity's bonds.

Anyone can buy bonds from corporations or governments. When you buy a bond, you're really loaning money to the company or government, who will pay it back later with interest.

- When a person buys a bond, they're using money already in circulation.

- When a central bank buys a bond, it creates cash.

10

289 reads

CURATED FROM

IDEAS CURATED BY

The idea is part of this collection:

Learn more about moneyandinvestments with this collection

How to start a successful business

How to build a strong team

How to market your business

Related collections

Similar ideas to Quantitative easing

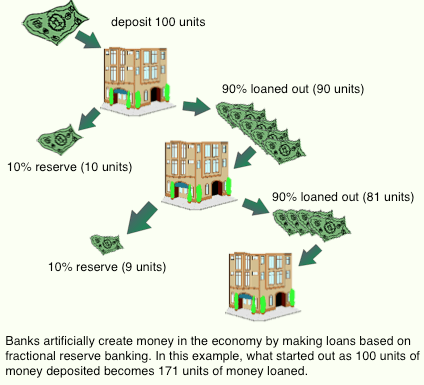

Fractional Reserve & Money Supply

Banks loan money they don't have. Most hold a limited reserve to serve the few who decide to make redraws. When the majority decides to liquidate their bank accounts we have what is called a bank run.

In order to protect the banks, central banks were created to provide a gu...

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates