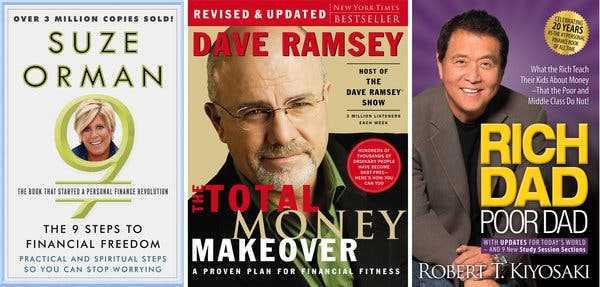

Popular Personal Finance Books are Inspirational

Most of the popular finance books lack substantive advice on investing. They are inspirational & their core message is a good one: You are ultimately responsible for your own financial success.

But a smart reader will have to go elsewhere for an in-depth discussion of how to set up a portfolio & choose among stocks, bonds, exchange-traded funds or mutual funds.

138

749 reads

CURATED FROM

IDEAS CURATED BY

The idea is part of this collection:

Learn more about moneyandinvestments with this collection

The importance of physical activity

The role of genetics in lifespan

How to maintain a healthy diet

Related collections

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates