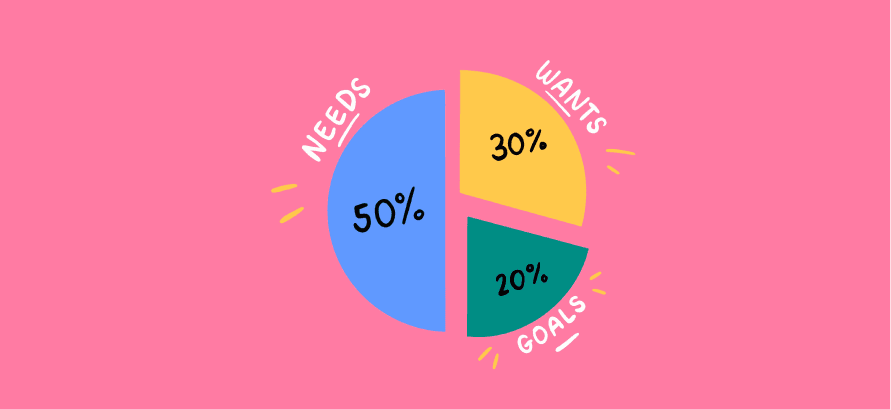

The 50-20-30 rule

It is a budget rule to help people reach their financial goals. It states that:

- You should spend up to 50% of your after-tax income on needs and obligations that you must-have or must-do.

- The remaining half should be split up between 20% savings and debt repayment and 30% to everything else that you might want.

1.3K

4.88K reads

CURATED FROM

IDEAS CURATED BY

Creator. Beer ninja. Travel lover. Twitter evangelist. Lifelong writer. Zombie expert.

The idea is part of this collection:

Learn more about moneyandinvestments with this collection

How to use storytelling to influence and persuade

How to create a compelling narrative

How to structure your story for maximum impact

Related collections

Similar ideas to The 50-20-30 rule

The 50/30/20 Rule

It breaks down your budget categories into three broad segments:

- 50%: Essential Expenses like housing, automobile expenses, groceries, insurance, utilities, etc.

- 30%: Discretionary Expenses (Non-essential) like Dining out, entertainment, drinks, etc.

The 50:30:20 budgeting method

Under this method, 50 percent goes to expenses, 30 percent goes to wants, and 20 percent goes to a combination of debt and savings.

A person with a healthy amount of disposable income but loads of debt could probably benefit more from the 50:30:20 method.

The 50/20/30 budgeting method

With the 50/20/30 budgeting method:

- 50% of your monthly spending goes toward essentials - your home, your food, etc.

- 20% of your monthly spending goes toward savings goals. It also includes paying down debts as it helps you build savings la...

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates