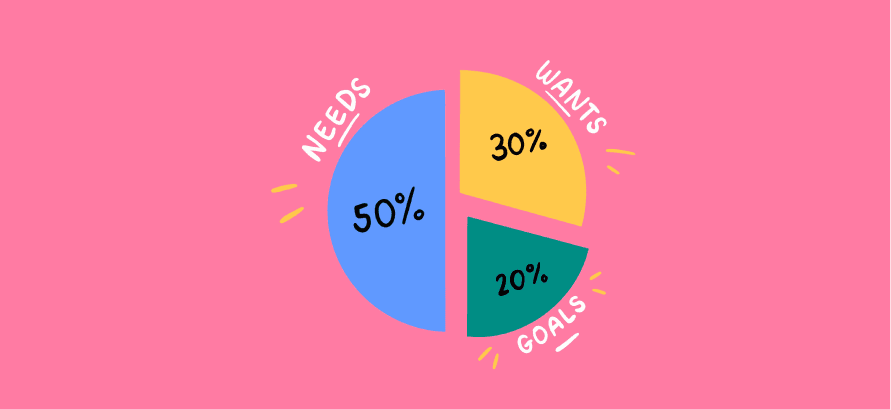

The 50/30/20 Rule

It breaks down your budget categories into three broad segments:

- 50%: Essential Expenses like housing, automobile expenses, groceries, insurance, utilities, etc.

- 30%: Discretionary Expenses (Non-essential) like Dining out, entertainment, drinks, etc.

- 20%: Financial Goals including mortgage, home, and educational savings.

If there is heavy credit-card debt, the financial goals should be 30% and non-essential spendings only 20%.

2.2K

7.43K reads

CURATED FROM

IDEAS CURATED BY

The idea is part of this collection:

Learn more about moneyandinvestments with this collection

Cultivating self-awareness and self-reflection

Prioritizing and setting boundaries for self-care

Practicing mindfulness and presence

Related collections

Similar ideas to The 50/30/20 Rule

The 50-20-30 rule

It is a budget rule to help people reach their financial goals. It states that:

- You should spend up to 50% of your after-tax income on needs and obligations that you must-have or must-do.

- The remaining half should be split up between 20% savings and debt repayment and 30% to ev...

The 50:30:20 budgeting method

Under this method, 50 percent goes to expenses, 30 percent goes to wants, and 20 percent goes to a combination of debt and savings.

A person with a healthy amount of disposable income but loads of debt could probably benefit more from the 50:30:20 method.

The 50/20/30 budgeting method

With the 50/20/30 budgeting method:

- 50% of your monthly spending goes toward essentials - your home, your food, etc.

- 20% of your monthly spending goes toward savings goals. It also includes paying down debts as it helps you build savings la...

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates