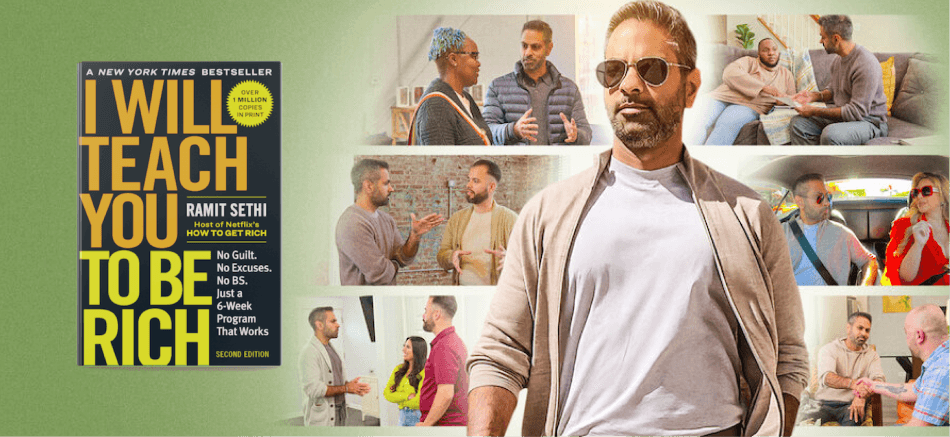

Anyone Can Become Rich

This is the main premise of the best selling book by Ramit Sethi. He structures his ideas into 4 buckets:

- Track your spending. This will help you see where your money is going and identify areas where you can cut back.

- Set financial goals. What do you want to achieve with your money? Once you know your goals, you can start making a plan to reach them.

- Pay off your debt. This is one of the most important things you can do to improve your financial situation.

- Invest for your future. This will help you grow your money and reach your financial goals.

2.41K

17.9K reads

CURATED FROM

IDEAS CURATED BY

The book behind the Netflix show

“

Similar ideas to Anyone Can Become Rich

Know Your Net Worth

It can help you to determine when you are and how to get where you want to be.

- You can identify areas where you spend too much money. Do you need it or merely want it?

- Pay Down Debt. You can develop a plan for paying down debt.

- Your net worth figures can motivate you to...

Create a Budget

Once you have organized your accounts into a notebook or an excel sheet, set aside the time to track your expenses so that you'd be able to identify where you spend the most should you need to cut back.

Being able to direct and redirect your money will ultimately lead you to a healthier fin...

Budgeting

Acknowledging areas where you are overspending can be an eye-opening experience. Creating a budget and sticking to it can help you save and reach your short- and long-term financial goals. This is not a one-time exercise.

Revisit and rework your budget if you have a financ...

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates