Currency Options

An “option” is a financial instrument that gives the buyer the right or the option, but not the obligation, to buy or sell an asset at a specified price on the option’s expiration date.

If a trader “sold” an option, then he or she would be obliged to buy or sell an asset at a specific price at the expiration date. Just like futures, options are also traded on an exchange.

However, the disadvantage in trading FX options is that market hours are limited for certain options and the liquidity is not nearly as great as the futures or spot market.

40

134 reads

CURATED FROM

IDEAS CURATED BY

I want to make summary of what I have learned about Forex so that I can refresh it again.

“

Similar ideas to Currency Options

Forms of trading

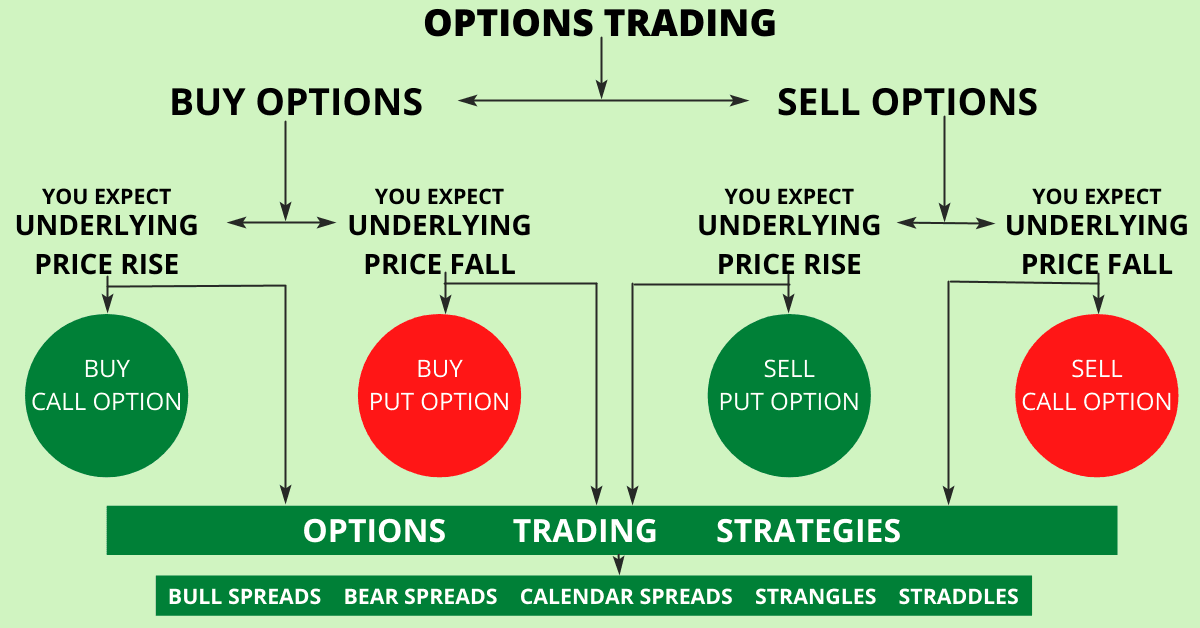

Options are divided into "call" and "put" options. With a call option, the buyer of the contract purchases the right to buy the underlying asset in the future at a predetermined price, called

Understanding Inverse ETFs

Many inverse ETFs utilize daily futures contracts to produce their returns. A futures contract is a contract to buy or sell an asset or security at a set time and price. Futures allow investors to make a bet on the direction o...

Option

An Option is the ability to take a predefined action for a fixed period of time in exchange for a fee. Options are all around us: movie or concert tickets, coupons, retainers, and licensing rights. In exchange for a fee, the purchaser has the right to take some specific action—at...

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates