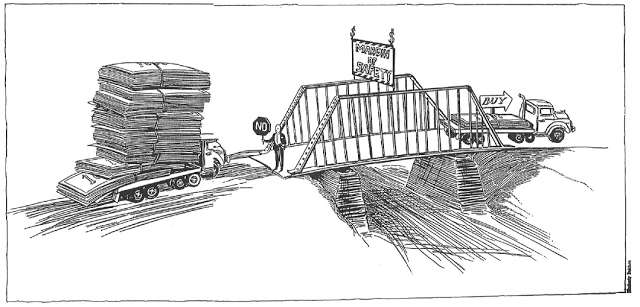

Oversold Businesses

4. “oversold businesses” at prices below their long-term intrinsic value, eventually the market would acknowledge its mistake and revalue them upward.

173

1.29K reads

CURATED FROM

IDEAS CURATED BY

Similar ideas to Oversold Businesses

Margin of Safety

This is a principle of investing wherein an investor purchases securities only when their market price is significantly below their intrinsic value.

The formula to determine the intrinsic value of something is:

Margin of Safety = Market Cap / Deep Value Barg...

Warren Buffet's Investing Philosophy

- Buffett takes this value investing approach to another level.

- Many value investors do not support the efficient market hypothesis (EMH) . This theory suggests that stocks always trade at their fair val...

What is Margin of Safety?

‘Margin of safety’ is the difference between a stock price and its intrinsic worth, or value.

So if a stock is trading at $70 in the market, and you calculate the company’s intrinsic value as $100, you have a margin of safety of $30 (100 minus 70). In other terms, the sto...

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates