Strategy Decision Making

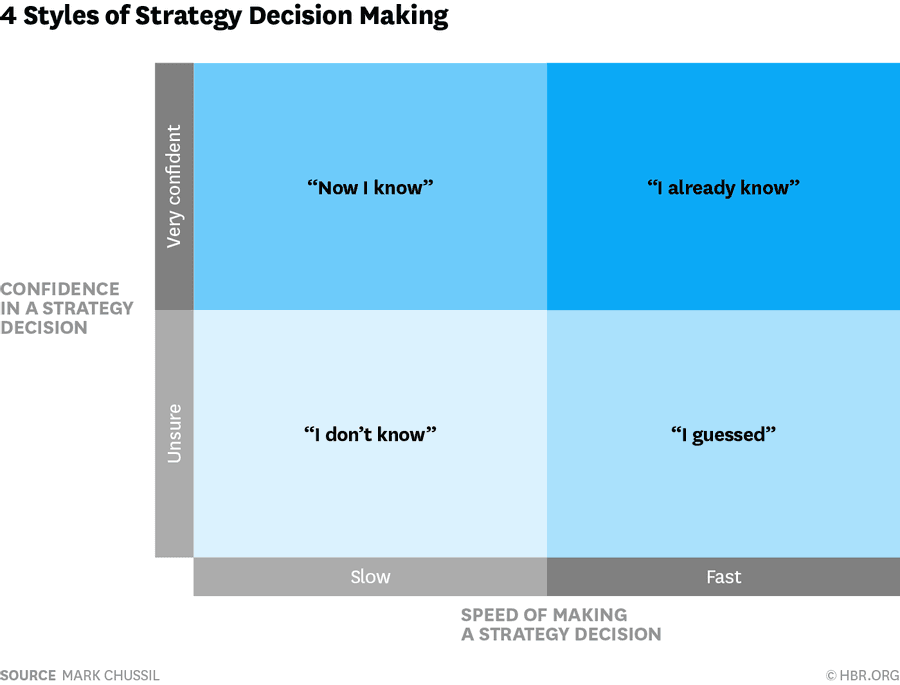

Imagine recording decision-makers' solutions to a competitive-strategy problem using four categories:

- Now-I-know

- I-already-know

- I-don't-know

- I-guessed

The Now-I-know and the I-already-know are very confident while I-do don't-know and the I-guessed are unsure. The Now-I-know and the I-don't-know are slow in making a strategy-decision while the I-already-know and the I-guessed are fast at making a decision.

286

873 reads

CURATED FROM

IDEAS CURATED BY

Traveling can make you smarter, more creative and improve your problem-solving abilities.

The idea is part of this collection:

Learn more about problemsolving with this collection

How to secure funding

How to market and sell your product or service

How to scale and grow your business

Related collections

Similar ideas to Strategy Decision Making

Good/bad strategy decision-makers

It's not easy to split people into the good/bad strategy decision-makers.

- Track records are useful to some extend. Those with business degrees seem to be good signs, but they may differ on what works. Veterans look promising, but so do outsiders with new ideas. ...

A lesson about overconfidence

When the overconfident think they already know the answer, they may believe it's a waste of time to keep looking for answers. But in deciding on a strategy, overconfidence may not lead to a workable option.

An essential lesson for competitive-strategy decision-makers is no...

Experiments with strategic decision making

A database of business executives, consultants, professors, and students was given the same unfamiliar pricing-strategy problem.

- Generally, the I-already-knows and the Now-I-Knows tend to be older males.

- The I-don't-knows tend to be somewhat younger.

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates