An ability (and willingness) to see truth’s absurd nature

It is an important skill to see the world as it is and not as we wish it should be.

None of the risks you take daily are likely to lead to death, but we act as though they would. An accurate understanding of reality is essential for producing good outcomes.

39

236 reads

CURATED FROM

6 Essential Insights on The Future from Warren Buffett and Charlie Munger

taylorpearson.me

6 ideas

·1.47K reads

IDEAS CURATED BY

Total food specialist. Friendly webaholic. Coffee fan. Proud analyst. Tv expert. Explorer. Travel nerd. Incurable beer advocate.

The idea is part of this collection:

Learn more about moneyandinvestments with this collection

Cultivating a growth mindset and embracing challenges

Developing adaptive thinking and problem-solving skills

Effective learning frameworks and approaches

Related collections

Similar ideas to An ability (and willingness) to see truth’s absurd nature

Benefits and dangers of chutzpah

Benefits of chutzpah

- It can push you to take good risks, such as a willingness to step forward in a bold action even though you may not have an idea of how you will pull it off.

- It can push you to focus on what you need to do where you would otherwise be num...

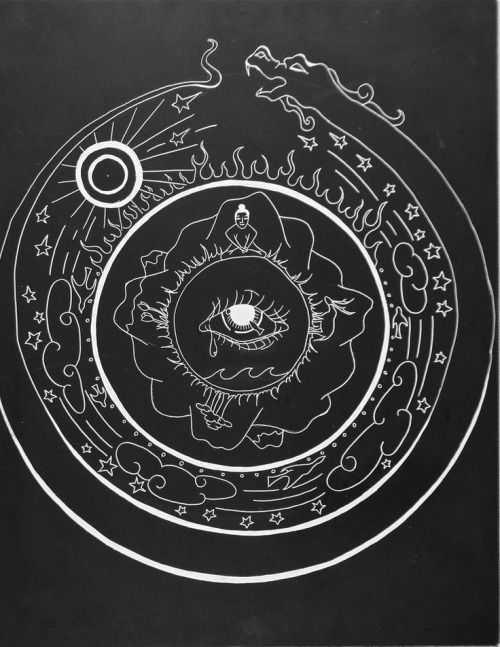

Samsara = Life of a Zombie

Samsara is a belief in Buddhism meaning the cycle of birth, life, death and rebirth. It is new life, but it is still full of suffering. As long as we are alive, suffering is present because it is natural for us to wish for good things not to end even though we knew that it would.

Jus...

4. Hold on to Your Power

When you go in begging for a favour it is unattractive and people are less inclined to help. You must act as though the favour is essential, but not necessary for them to help.

In doing so, you keep some of your power and are more likely to achieve what you want.

Remember, to not so...

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates