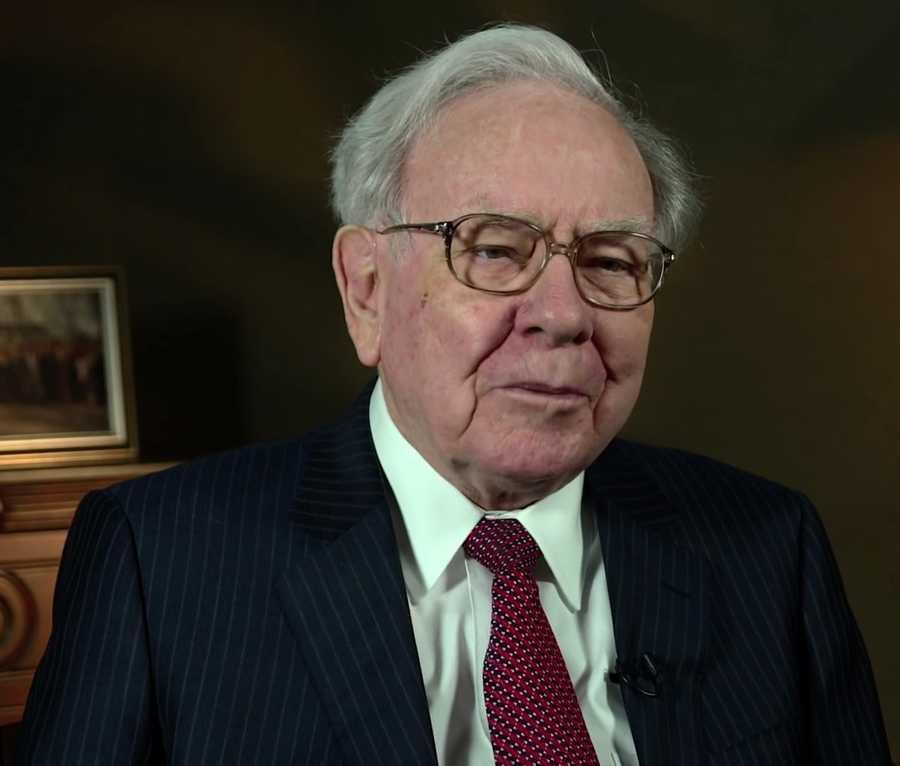

6 Essential Insights on The Future from Warren Buffett and Charlie Munger

Curated from: taylorpearson.me

Ideas, facts & insights covering these topics:

6 ideas

·1.47K reads

6

Explore the World's Best Ideas

Join today and uncover 100+ curated journeys from 50+ topics. Unlock access to our mobile app with extensive features.

A sustainable competitive advantage

Warren Buffett states that if you aren't willing to own a stock for ten years, don't even think about owning it for ten minutes.

Human nature is most concerned with short term loss aversion, not long-term gain seeking. Because we are so short-term oriented, it's an enormous advantage if you can operate on a longer time than the competition. Having a ten, twenty, and thirty-year track record of ethical behaviour is a very defensive career position.

43

331 reads

An ability (and willingness) to see truth’s absurd nature

It is an important skill to see the world as it is and not as we wish it should be.

None of the risks you take daily are likely to lead to death, but we act as though they would. An accurate understanding of reality is essential for producing good outcomes.

39

236 reads

Future and Past for successful investors

“The future will not be as good as the past but it doesn’t have to be.” This statement from Charlie Munger summed up his thoughts on public markets. Public market in the U.S. will not repeat the success of the late 90s in the 21st century.

Successful investors seem to focus on smaller, private markets, where it's more difficult to invest and where there's less competition. It's worth noting that advances in communication technology and the huge amount of capital created in the second half of the 20th century have created a more competitive public market.

33

215 reads

The law of the conservation of trust

Researcher Robin Dunbar says, on average, we can only maintain a trusted social group of one hundred and fifty people. We can change which people, brands, and ideas we trust, but the number stays the same.

We are exposed to an increasing number of brands each year, but with no more trust and attention to hand out. The result is a shift in how companies grow and how marketing works. Warren Buffett shows a change from "push" marketing to "pull" marketing. We are entering a trust shortage. The individuals and brands which are "long trust" will win.

40

259 reads

Stick to your Circle of Competence

Charlie Munger once commented that "in order to disagree with somebody you must first understand their argument better than they do."

The most common way people lose money is to overestimate how clever they are and how much they know. Even after a fifty-year investing career, both Warren Buffett and Munger read over 500 pages a day and still limited themselves to a small circle of competence where they can explain the other side's argument better than they can.

42

213 reads

Context is king

Not many people have knowledge in their head both through a long life and reading widely, and across private industries, government, etc., to be able to form a broad perspective.

Taking your money and starting from the perspective of how to make a better tire will yield a very different result to asking "how do I maximize returns on capital?"

32

225 reads

IDEAS CURATED BY

Total food specialist. Friendly webaholic. Coffee fan. Proud analyst. Tv expert. Explorer. Travel nerd. Incurable beer advocate.

Piper E.'s ideas are part of this journey:

Learn more about moneyandinvestments with this collection

Cultivating a growth mindset and embracing challenges

Developing adaptive thinking and problem-solving skills

Effective learning frameworks and approaches

Related collections

Similar ideas

7 ideas

Charlie Munger: Mental Models for the Rest of Your Life

The Swedish Investor

6 ideas

Charlie Munger: Mental Models for the Rest of Your Life (PART 2)

The Swedish Investor

5 ideas

Charlie Munger: Mental Models for the Rest of Your Life (PART 4)

The Swedish Investor

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates