Budgeting myths

- Myth - I don't need to budget: A budget focus on identifying all the expenses that are likely to occur during the month, quarter, and year. A budget can identify costs that could be reduced or cut.

- Myth - I'm not good at math: Budgeting software only requires you to follow instructions.

- Myth - My job is secure: You should always be prepared for a job loss and have at least three months' worth of living expenses in the bank. With budgeting, you will know how much you spend each month.

- Myth - Unemployment insurance will tide me over: You may be ineligible for unemployment insurance or the benefits may fall short of the amount you need.

- Myth - I don't want to deprive myself: The aim of budgeting is to tell you where your money is going and ensure you're able to save a little each month, ideally 10% of your income.

- Myth - I don't have anything big to save for: While you may not have any major savings goals at present, your situation and attitudes are likely to change over time.

- Myth - I'm debt-free: However, being debt-free without any savings won't pay for an emergency.

- Myth - I always get a raise or tax refund: It's never a good idea to count on unreliable sources of income.

- Myth - I don't have the discipline: To protect yourself from your own spending habits, set up an automatic transfer to a savings account.

131

332 reads

CURATED FROM

IDEAS CURATED BY

"Making money is art and working is art and good business is the best art." ~ Andy Warhol

The idea is part of this collection:

Learn more about moneyandinvestments with this collection

How to use storytelling to connect with others

The psychology behind storytelling

How to craft compelling stories

Related collections

Similar ideas to Budgeting myths

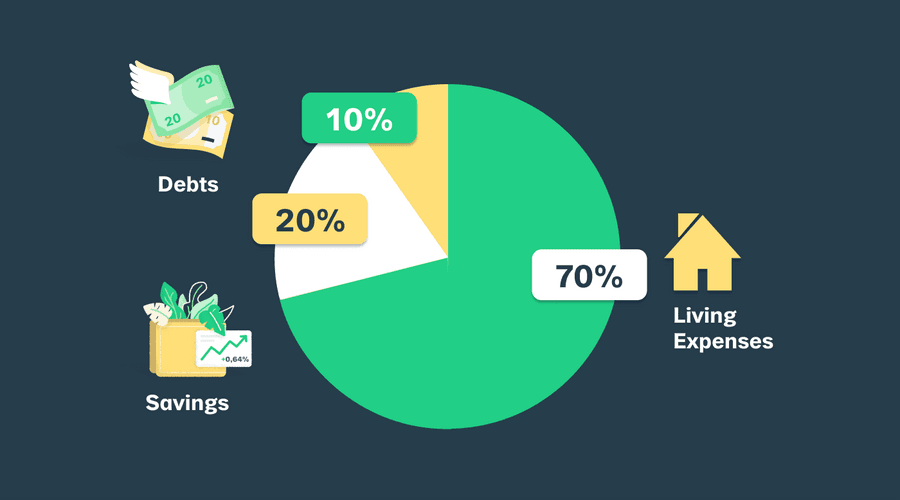

The 70:20:10 budgeting method

This method suggests that you allocate 70 percent of your income to expenses, 20 percent to savings, and the remaining 10 percent to debt.

70:20:10 may work for someone with a healthy emergency fund and minimal debt.

Allocating expenses

The most common buckets are:

- Expenses, or your needs: housing, food, transportation, clothing, insurance, childcare, etc.

- Debt - monthly debt obligations: personal loan, student loan, auto loan, and credit card payments etc.

- Savings, including fund...

The 50:30:20 budgeting method

Under this method, 50 percent goes to expenses, 30 percent goes to wants, and 20 percent goes to a combination of debt and savings.

A person with a healthy amount of disposable income but loads of debt could probably benefit more from the 50:30:20 method.

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates