Options Market

A public market for options, giving the buyer an option to buy or sell a cryptocurrency at a specific strike price, on or before a specific date.

348

163 reads

CURATED FROM

IDEAS CURATED BY

The idea is part of this collection:

Learn more about crypto with this collection

The impact of opportunity cost on personal and professional life

Evaluating the benefits and drawbacks of different choices

Understanding the concept of opportunity cost

Related collections

Similar ideas to Options Market

Forms of trading

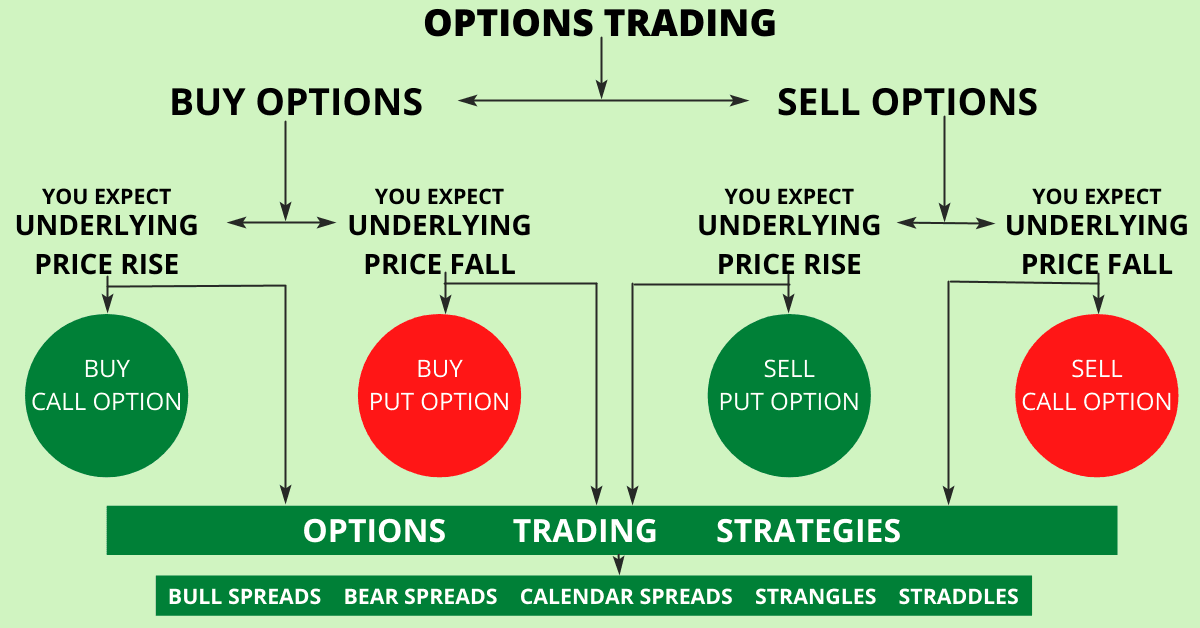

Options are divided into "call" and "put" options. With a call option, the buyer of the contract purchases the right to buy the underlying asset in the future at a predetermined price, called

Now, let's say a call option on the stock with a strike price of $165 that expires about a month from now costs $5.50 per share or $550 per contract. Given the trader's available investment budget, they can buy nine options for a cost of $4,950. Because the option contract controls 100 shares, th...

Trading in an Equity Market

In the equity market, investors bid for stocks by offering a certain price, and sellers ask for a specific price. When these two prices match, a sale occurs. Often, there are many investors bidding on the same stock. When this occurs, the first investor to place the bid is the first to get the st...

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates