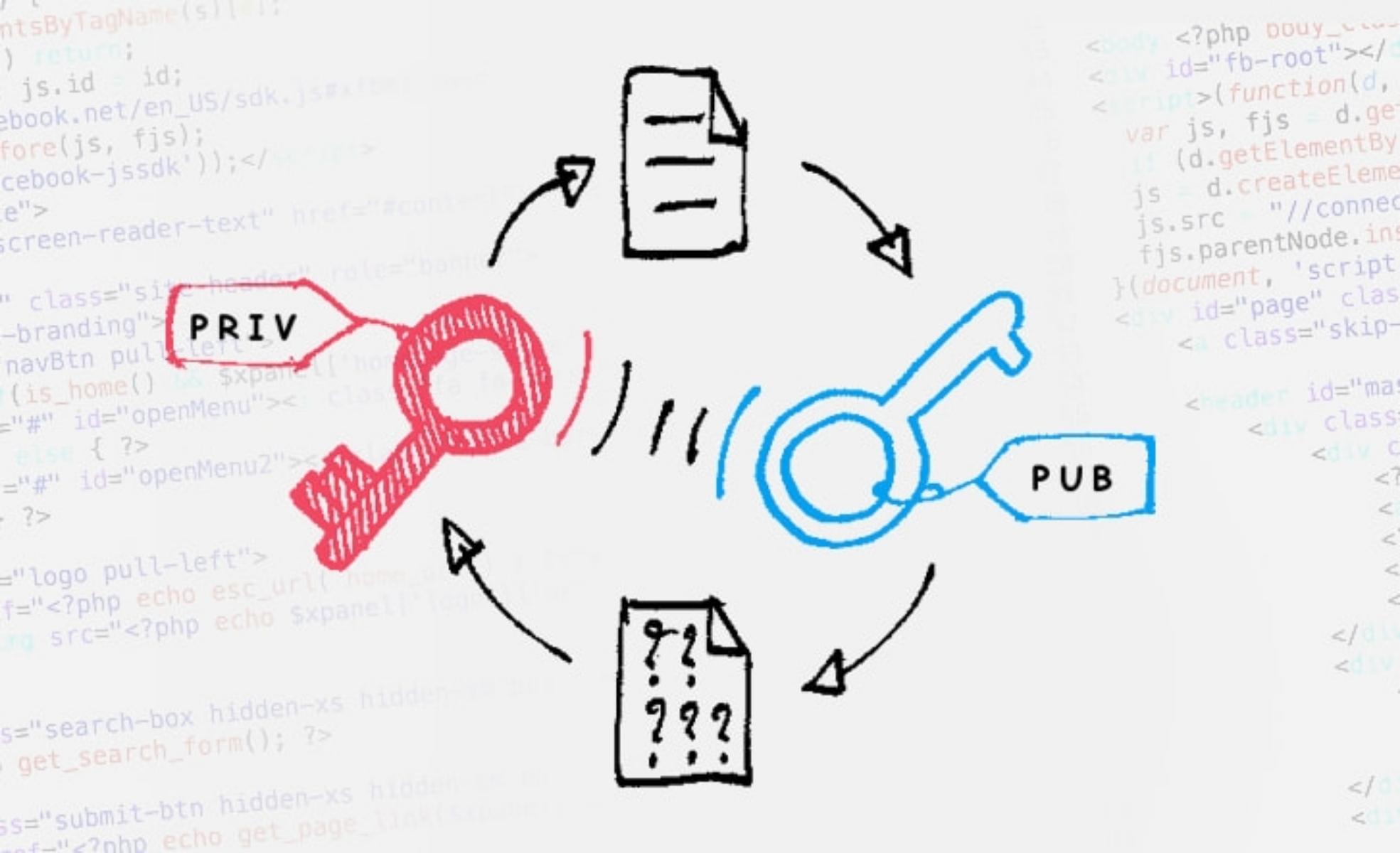

Private and public keys

In Bitcoin, you have public addresses and private keys:

- The public address is like an email address, where you can receive Bitcoin. It is safe to give someone your Bitcoin public address, if you would like them to send you some Bitcoin. A Bitcoin public address will look something like this: 3J98t1WpEZ73CNmQviecrnyiWrnqRhWNLy Your hardware wallet will be able to generate new public addresses whenever you need them.

- A private key is like a 64characters password to your email. You would never share it with anyone. Looks like this: E9873D79C6D87DC0FB6A5778633389F4453213303DA61F20BD67FC233AA33262

430

1.46K reads

CURATED FROM

IDEAS CURATED BY

Life-long learner. Passionate about leadership, entrepreneurship, philosophy, Buddhism & SF. Founder @deepstash.

The idea is part of this collection:

Learn more about crypto with this collection

Understanding the basics of cryptocurrency

How to store cryptocurrency securely

Risks and benefits of investing in cryptocurrency

Related collections

Similar ideas to Private and public keys

How Identity Works in Web3

In Web3, Identity also works much differently than what we are used to today. Most of the time in Web3 apps, identities will be tied to the wallet address of the user interacting with the application.

Unlike Web2 authenticat...

The structure of bitcoin

- Bitcoin is a peer-to-peer money network. You don't have to pay a fee to a bank when you send money to another party.

- Bitcoin is finite. There can only be 21 million bitcoin in the world. More than 17 million have already been mined while the rest w...

How Do Virtual Private Servers Work?

Virtual private servers work by using software to create a number of virtual machines on a single physical server. Each of these virtual servers has access to its own dedicated resources and can't interact with any of the other servers, which is why they're referred to as private...

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates