Vladimir Oane's Key Ideas from A Beginner's Guide To Bitcoin

by Matthew R. Kratter

Ideas, facts & insights covering these topics:

9 ideas

·19.5K reads

128

1

Explore the World's Best Ideas

Join today and uncover 100+ curated journeys from 50+ topics. Unlock access to our mobile app with extensive features.

Store of Value

A store of value is a way of transmitting wealth across space and across time. it is useful when you want to preserve the surplus value for future spending.

Gold 🪙 has historically been the defacto preserver of value. From the 70e however our money are no longer linked to gold so Central Banks are stealing our savings through money printing and inflation.

441

3.69K reads

The problem with GOLD

Gold is not a perfect store of value:

- It is difficult to transport. During wars many people lost theyir gold savings.

- It's difficult to store. Special facilities are needed but even then history is filled with examples of government confiscations.

- It's difficult to verify. Special knowledge is required to test the purity of the metal.

- It's hard to divide.

420

2.39K reads

Bitcoin is better money

Bitcoin solves all of Gold problems.

- I can hold my Bitcoin in self-custody, and no one can take it from me. I’m not dependent on a bank or other third party.

- The Federal Reserve cannot devalue my savings that are held in Bitcoin. If the Fed prints more money, the price of my Bitcoin in US dollars will go up to compensate for this new money printing.

- It’s also easy to send anyone some Bitcoin. No one can stop me from sending it or stop you from receiving it, even if they don’t like our political views.

434

2.33K reads

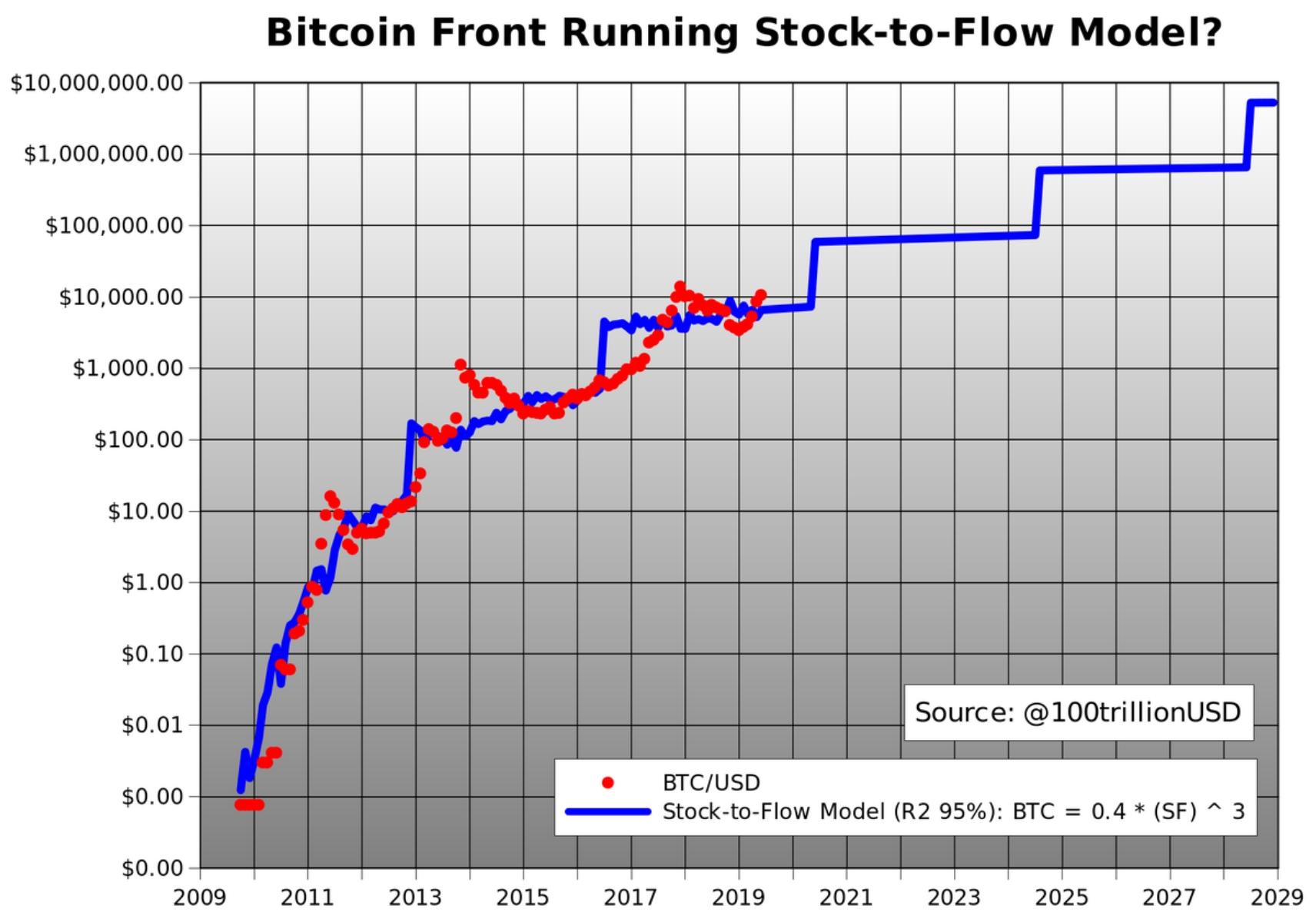

Plan B - a method to predict bitcoin value

Is a paper famous for coming up with a valuation got Bitcoin. It borrows the concept of “stock-to-flow” from precious metals analysts. “Stock-to-flow” (henceforth “S2F”) as a way of measuring the relative scarcity of a commodity. With the analogy the price of bitcoin is predicted to hit:

- 2021: $100,000

- 2024: $400,000

- 2028: $3,000,000

443

2.53K reads

Information about the future is reflected in the current price

One of the hallmarks of the “efficient market hypothesis” (EMH) is that current information and future information that is known today will get priced into an asset.

If everyone knows that Apple will beat earnings this quarter, those expected earnings will get priced into Apple’s stock even before earnings are actually reported. Likewise, if everyone begins to believe that there is a 50% chance that PlanB’s model will still be working well in 2028 the fair value or expected value of Bitcoin should be $1,500,000 today.

418

1.89K reads

Bitcoin's low no of transactions/second

Bitcoin's low number of transactions may make it less suitable for daily transaction. It does not matter. “Bitcoin as store of value” Is what matters.

Like gold coins, Bitcoin is simply too valuable to be used in daily transactions. There is no reason that we will ever need to use Bitcoin to buy a cup of coffee. That transaction size is handled fine by Visa or in the future, central bank digital currencies (“FedCoin”) may provide the main payment rails for the financial system.

414

1.68K reads

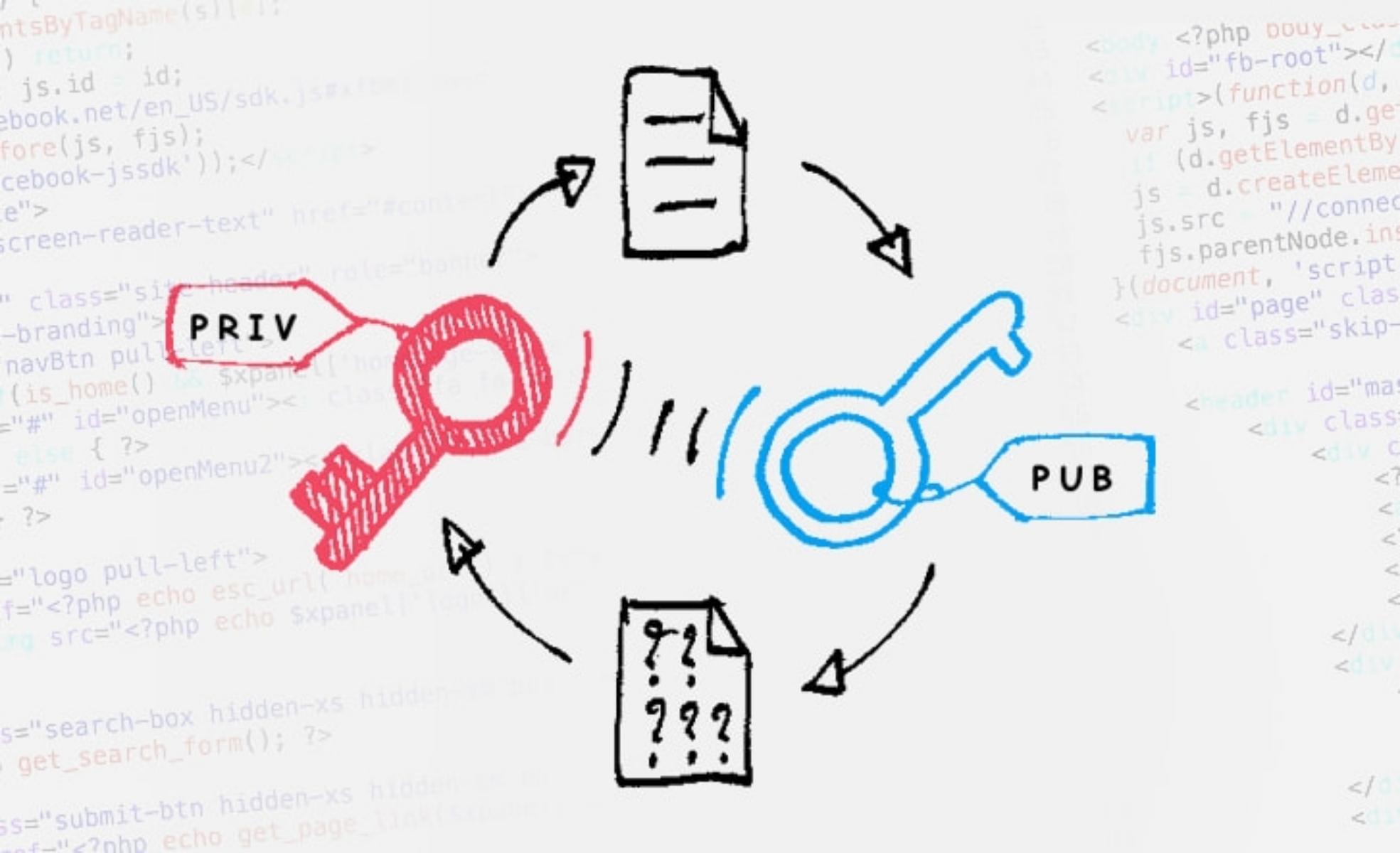

“Not your keys, not your coins.”

If you do not hold your own private keys, the Bitcoin is not really yours. If someone else holds your private keys (like PayPal, Robinhood, or any cryptocurrency exchange), you do not control your own Bitcoin. The Bitcoin does not truly belong to you. It can be lost, hacked, seized, or otherwise confiscated.

If you need to log in to an account to view your Bitcoin, it probably means that someone else is holding your private keys for you.

425

1.64K reads

Private and public keys

In Bitcoin, you have public addresses and private keys:

- The public address is like an email address, where you can receive Bitcoin. It is safe to give someone your Bitcoin public address, if you would like them to send you some Bitcoin. A Bitcoin public address will look something like this: 3J98t1WpEZ73CNmQviecrnyiWrnqRhWNLy Your hardware wallet will be able to generate new public addresses whenever you need them.

- A private key is like a 64characters password to your email. You would never share it with anyone. Looks like this: E9873D79C6D87DC0FB6A5778633389F4453213303DA61F20BD67FC233AA33262

430

1.46K reads

Top 10 commandments of Bitcoin

- Value your wealth in Bitcoin

- Dollar cost average into Bitcoin

- Never sell your Bitcoin

- Never trade in and out of Bitcoin

- Ignore the price of Bitcoin

- Not your keys, not your coins

- Never share your recovery seed

- Don’t advertise your Bitcoin holdings

- Ignore all other cryptocurrencies

- You can never be too bullish on Bitcoin.

465

1.9K reads

IDEAS CURATED BY

Life-long learner. Passionate about leadership, entrepreneurship, philosophy, Buddhism & SF. Founder @deepstash.

Vladimir Oane's ideas are part of this journey:

Learn more about crypto with this collection

Understanding the basics of cryptocurrency

How to store cryptocurrency securely

Risks and benefits of investing in cryptocurrency

Related collections

Discover Key Ideas from Books on Similar Topics

14 ideas

Learning Forex (Preschool) - What is Forex?

babypips.com

7 ideas

Balaji Srinivasan's monster 8h podcast

Lex Fridman Podcast

1 idea

Proof-of-Stake (vs proof-of-work)

Simply Explained

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates